Overnight Snapshot

The Day Ahead

0930hrs UK UK Consumer Price Index (est 0.3%mom / 2.66%yoy vs previous 0.4% / 2.7%

0930hrs UK UK Retail Price Index (est 278.8 vs previous 278.1)

0930hrs UK UK Retail Price Index (est 0.25%mom / 3.54%yoy vs previous 0.8% / 3.6%)

0930hrs UK UK Producer Prices Input (est 0.31%mom / 4.26%yoy vs previous -1.1% / 3.4%)

0930hrs UK UK Producer Prices Output (est 0.14%mom / 2.34%yoy vs previous 0.0% / 2.6%)

0930hrs UK UK House Price Index (est 4.6%yoy vs previous 4.9%)

1000hrs UK EU Eurozone CPI (est 0.82%mom / 1.4%yoy vs previous 0.2% / 1.1%)

1330hrs UK US New York Fed President William Dudley speaks in New York

1415hrs UK UK Bank of England Policy Committee members Alex Brazier, Donald Kohn and Martin Taylor testify before UK Treasury Committee

1500hrs UK CA Bank of Canada Interest Rate Decision (est 1.25% vs previous 1.25%)

1530hrs UK US DOE Crude Oil Inventories (est 393.58K vs previous 3306K)

1530hrs UK US DOE Gasoline Inventories (est -103.5K vs previous 458K)

1900hrs UK US The Federal Reserve releases the Beige Book

2015hrs UK US New York Fed President William Dudley speaks in The Bronx

2115hrs UK US Washington Fed Governor Randal Quarles speaks in Washington

US earnings releases today include US Bancorp, Abbott Labs, Morgan Stanley, American Express, Alcoa

The Day So Far….

STOCKS: US Indexes rallied yesterday with broad based gains as earnings from Netflix and United Health added to the optimism with S&P500 earnings so far around 28% up. Netflix rose 9% after they smashed analyst expectations on subscriber numbers. Amazon provided a big boost to the S&P500 with a 4% jump on signs the US Supreme Court is hesitantant to let statesforce out of state retailers to collect sales tax.

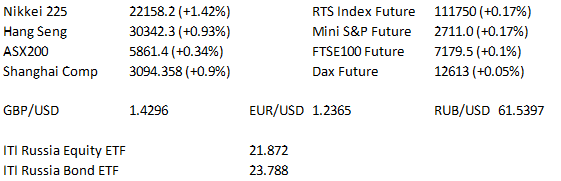

The majority of the major Asian indices moved higher, following on from Wall St.'s earnings-inspired gains and as reports emerged suggesting that Mike Pompeo travelled to North Korea to meet with the country's leader Kim Jong Un. - The Nikkei 225 added 1.3% as the JPY softened, with the Telecoms sector leading the move higher as all of the major sectors operated in the green. - Hong Kong's

Hang Seng added 0.1%, as the energy sector led the way higher, while consumer staples weighed. The mainland's CSI 300 lost 0.6% as telecoms waivered, while banks benefitted from the PBoC's targeted RRR cut. - Australia's ASX 200 added 0.2%, with consumer discretionary leading the way, although telecoms names weighed. - US index futures continued to edge higher, with the e-mini S&P adding

4 points, as the mini Dow added over 50 points.

US TSYS: It has been a relatively sedate session for the space thus far, with a report suggesting that FBI director Mike Pompeo travelled to North Korea to meet with Kim Jong Un keeping a lid on Tsys - T-notes have operated in a 3+ tick range. - The curve has traded in mixed fashion with 30-Year yields easing a little, which has led to further flattening. - Fed voter Bostic offered little fresh insight re: MonPol.

OIL: Oil edged higher overnight with WTI & Brent adding just shy of $0.40 to trade around $66.90 & $71.95 respectively. - This came after reports suggested that the latest API crude inventory released included a headline drawdown, while gasoline, distillate & Cushing stocks also fell according to the reports..

GOLD: Gold lost $3 or so to trade at $1345/oz as Asian stocks ticked higher.

FOREX: USDCAD trades 20 or so pips higher at ~1.2570 heading into today's BoC decision, with the overwhelming majority expecting the BoC to stand pat. It is worth noting that there is some USD 2.07bln worth of 1.2600 USDCAD option expiries set to roll off at today's 10AM NY cut, with an additional USD 910mln of 1.2585 options set to roll off. - JPY has softened a tad following reports that Mike Pompeo travelled to North Korea to meet with the country's leader Kim Jong Un, with USDJPY last dealing at 107.30. - The Antipodeans lacked any real conviction ahead of tomorrow's Aussie Labour market report & Kiwi CPI releases. - EUR & GBP managed to lodge marginal gains vs USD, with UK CPI dominating Wednesday's morning docket. There is talk of offers around 1.2400 in EURUSD.

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk