Overnight Snapshot

The Day Ahead

0735hrs UK JN Bank of Japan’s Amamiya speaks in Tokyo

0815hrs UK DE Bundesbank Board Member Joachim Wuermeling speaks in Frankfurt

0830hrs UK FR Governor of the Bank of France, Francois Villeroy de Galhau speaks in Paris

0900hrs UK EU ECB Executive Board Member Sabine Lautenschlager speaks in Sintra

0900hrs UK EU ECB Governing Council Member Ewald Nowotny speaks in Vienna

1045hrs UK EU ECB Governing Council Member Knot speaks in Amsterdam

1100hrs UK UK CBI publishes the June Industrial Trends Survey

1130hrs UK EU ECB’s Benoit Coeure speaks in SIntra, Portugal

1330hrs UK US Current Account Balance (est -$131bln vs previous -$128.2)

1430hrs UK EU Fed Chair Jerome Powell, ECB President Mario Draghi, RBA’s Philip Lowe and BOJ’s Kuroda speak on a panel in SIntra

1500hrs UK US Existing Home Sales (est 5.52mln vs previous 5.46mln)

1530hrs UK US DOE Crude Oil Inventories (est -2429K vs previous -4143K)

1530hrs UK US DOE Gasoline Inventories (est -668K vs previous -2271K)

1730hrs UK DE Bundesbank Board Member Joachim Wuermeling speaks (again) in Frankfurt

Earnings from the US today include Micron Technology

No major UK or European earnings

HEADLINE NEWS

: GENERAL ELECTRIC TO FALL OUT OF THE DOW INDEX

: DEBENHAMS PROFIT WARNING – MORE UK HIGH STREET WOE

: ADIA TAKES STAKE IN PENSIONS INSURANCE CORPORATION

The Day So Far….

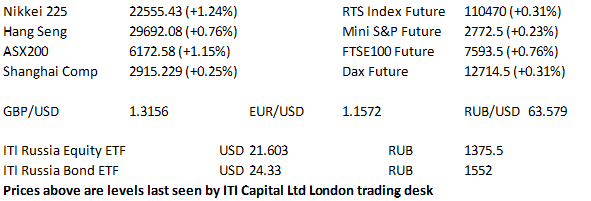

STOCKS: US stocks fell yesterday as a sharp escalation in the trade dispute between the USA and China rattled markets and caused the Dow to turn into negative territory for the year. President Trump threatened to impose a 10% tariff on a further $200bln of Chinese goods, with Beijing warning it would retaliate. Trump said his statement followed China’s decision to raise tariffs on $50bln of US goods which followed the White House announcement of tariffs on $50bln of Chinese goods from Friday. The Dow fell 287.26 points to 24700.21 after ending 2017 at 24719.22. The S&P500 closed 11.16 points lower at 2762.59 whilst the Nasdaq100 eased back 23.364 points to close at 7228.04

Asian regional indices trod carefully, operating in mixed fashion after a broad, yet limited bout of risk aversion hit markets in the morning session, with no catalysts apparent. The Nikkei 225 finished the morning session virtually unchanged, tracking USD/JPY and broader risk flows, with the health care and utilities sectors printing the largest gains, while the materials and energy sectors provided the most weight. Afternoon trading however proved a different matter, with the index posting steady gains throughout the session The Hang Seng printed modest losses early on, led lower by the telecoms sector, while the soothing messages from the PBoC Governor & various state-owned media outlets did little to stir bullish impulses on the Chinese mainland as Chinese indices underperformed their regional counterparts. However the bargain hunters pushed indices forward in afternoon trading. Australia's ASX 200 was once again the early outperformer, adding 0.8% as the financials sector led the index to fresh multi-year highs with further gains added later in the day, printing a high of 6172.6.

US TREASURYS: US Tsys have operated in a rather sedate manner, when we compare today's session to Tuesday's. - A brief bout of risk off flows hit in the middle of the session, but quickly abated as USD/JPY moved back above Y110.00 and equity indices recovered. This was perhaps aided by the fact that the USD/CNY fix was not quite as high as most had estimated.

JGBS: Futures eased a touch in the morning session, but stuck to a tight range, operating in familiar territory. - The 10-20 Year sector experienced some modest underperformance in cash dealing. - The latest round of BoJ Rinban operations, covering the 5-25+ Year buckets, was left unchanged in terms of size. Looking at the breakdown of the operations the offer to cover ratio across all 3 buckets held steady.

OIL: The major oil benchmarks managed to print modest gains after the latest round of API inventory data showed a larger than expected headline crude draw, according to reports, while the product inventories exhibited a build. - Elsewhere the OPEC+ summit in Vienna continues to garner attention with Iran continuing to voice its opposition to any increase in crude production under the OPEC+ agreement. Both WTI and Brent futures trading 40c higher at $65.47 and $75.48 respectively

GOLD: The yellow metal continues to operate around $1275/oz as the strength of the USD capped the price of the precious metal. A tight range has seen the front month futures trading between $1278.6 and $1275.1, currently printing just above the lows

FOREX: A brief bout of risk off flows hit in the middle of the session, but quickly abated as USD/JPY moved back above Y110.00 and equity indices recovered. This was perhaps aided by the fact that the USD/CNY fix was not quite as high as most had estimated. - USD/JPY failed to breach Y110.23 (200-dma) and last deals at Y110.10. USD/JPY risk reversals have taken a hit on the back of yesterday's trade war headlines, with both the 1- and 3-Month 25 delta measures falling to levels not seen since late March, perhaps indicating that markets had been underestimating the chances of full scale trade war. Both measures now trade back from worst levels, but remain notably lower. AUD/JPY found support around Y81.00 & rebounded to trade a touch higher on the session, although it now operates off of best levels. Trade war worry, an uninspiring dairy auction & fall in NZ Q2 consumer confidence have weighed on NZD over the last 24 hours, although the Kiwi ignored the latest round of BoP data ahead of tomorrow's Q1 GDP release.

Please contact ITI Capital London trading desk on dealing@ITICapital.com for further information or updates

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk