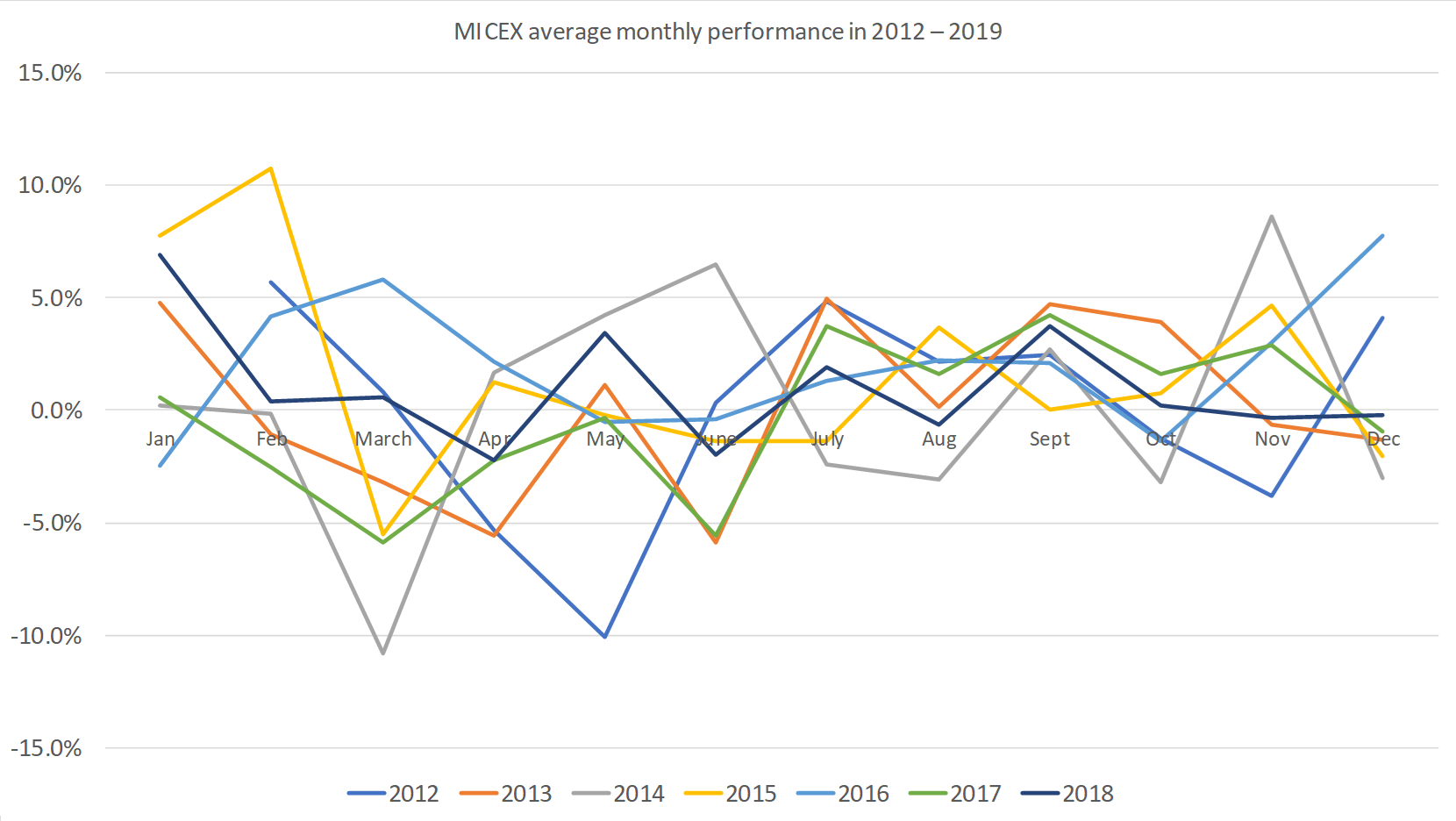

Seasonality

- August has traditionally been the worst period for the Russian, U.S., and therefore for the global stock market. The biggest and average August drops for MICEX since 1998 have been 44% and 0.5% respectively, for S&P 500 — 15% and 1% respectively. August was traditionally the worst months for 10 yrs US Treasury yields which declined by over 20 p.p.

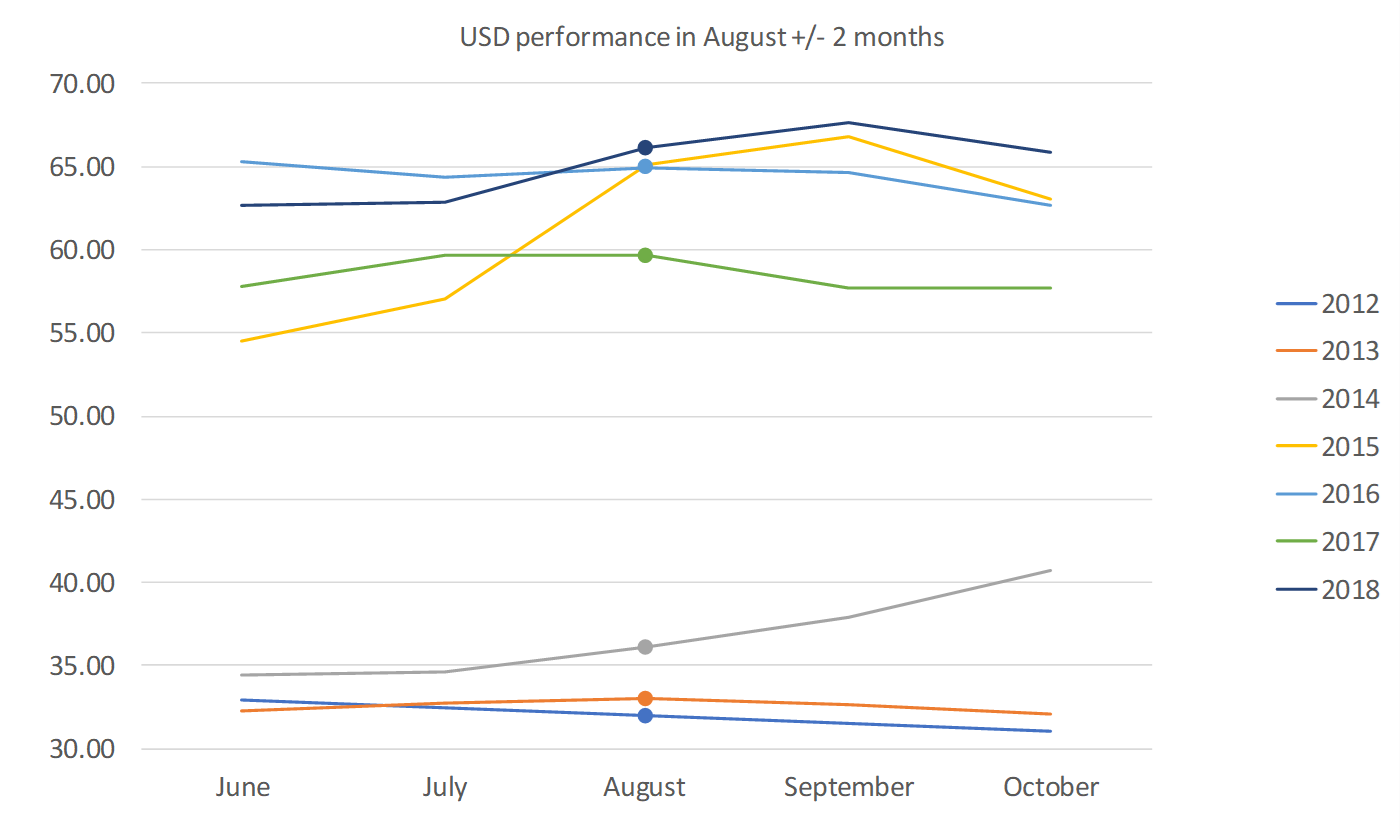

- The rouble track record since 1998 suggests that the Russian currency hasn't been subject to major declines in August (the biggest monthly drop was 3%) in contrast to May and October. Many assets, including gold, oil and EM currencies tend to decline during the month of October in large part due to robust growth in the preceding months and growing geopolitical risks

Demand for risks to extend

- Despite sell off since July 23rd which erased over $1,3 trln of global equity market we believe that markets will eventually return to record highs, supported by better than expected earnings in both the US and in Europe

- For us, this would mean increasing the Equity vs Bond overweight from moderate to large; broadening the overweight of some Cyclicals like Tech and Discretionary to also include Financials; and broadening the overweight of EM Bonds to Equities and FX as well

Why?

- Economic hard indicators such as retail sales and IP were more resilient, suggesting that earnings could surprise positively again, similar to the trend seen in both Q4 and in Q1 results. EPS growth is showing a single-digit gain rather than contraction; and weak sectors have mostly been those trade-exposed (Industrials, Materials), so highlight limited contagion from tariffs

- China (one 50 bps RRR cut plus lagged impact of previous fiscal stimulus) and the ECB (one cut in September and QE relaunch in Q4) can stabilize and then revive global industry

- US-Iran tensions persist, but as we noted last week, it is becoming increasingly difficult for this issue to destabilize global markets through a materially higher oil price when crude markets are in surplus and US sanctions have already triggered a collapse in Iranian exports

- We are still minded to think that President Trump will settle for a partial agreement later this year rather than raise tariffs again and risk a market downturn ahead of 2020 elections, but confidence in this view is not high

Key risks

- The potential for a hard Brexit on October 31st is intact given the unrealistic negotiating position advanced by new Prime Minister Johnson and the pro-Brexit orientation of his Cabinet

- The US-China trade and technology war remains the most material geopolitical risk since US demands are too comprehensive to be realistic

Top picks

- Synchronized growth stability lift in H2 on the back of a global central bank easing cycle, the portfolio carries both US overweights (in stocks) and EM overweight’s (in duration plus high-yield currencies in Latam)

- It’s also long Gold on a view that real interest rates will be heading lower into 2020, though some combination of central bank easing to lower nominal rates and some marginal success in lifting inflation

- Investors may use various types of hedging strategies any month, though the current market climate should be considered. Our current recommendations on hedging tools include the purchase of structured products for stocks of Russian or foreign companies that provide capital protection and a share in returns from securities growth

Russian stock market

- Most of Russia's major public companies are set to release financial results for the second quarter in August, with some of them announcing interim dividends, any material earnings miss may affect the MICEX index in the coming month

- Our MICEX target for the remaining 2019: +10%, to 1500 p. Out top picks now include Lukoil, Tatneft, Sberbank and Severstal

Sources: ITI Capital, Bloomberg

U.S. Stock market

- US earnings this quarter might be understated when looking at the weak PMI momentum

- At a sector level, Cyclicals outperformed Defensives in Europe and in the US, with Tech and the European Autos leading

- In addition to cyclical sectors, the portfolio carries overweights such as medical stocks, including Cigna, Abiomed and Gilead Science

- Our S&P 500 target for the remaining year: +7%, to 3224 p

FX and eurobonds

- OW positioning headwinds in EM hard currency sovereign bonds, which reached new all-time highs, while more modest EM local market bond OWs were little changed

- On the revaluation side, we recommend reliable issuers offering sovereign risk premia, such as Mexico (Credito Real 26, Pemex 27)

- The risks to the rouble in August are limited, USDRUB will hover under 64 this month and under 65 through December. Local risks for the rouble appear limited, the pressure on the forex balance will not be significant, as the period for dividend payments and conversion of roubles into dollars for payments to non-resident holders ended and external debt payments have been falling from July peaks

- At the same time, the inflow of non-residents into OFZs will be limited, as real interest rates decline and investors opt for carry-trade, as the Bank of Russia is on track for a third 25 bps rate cut this year

- Geopolitics, including sanctions, poses a primary threat to the rouble, while the correlation with oil price remains weak. Multi-currency holdings ahead of heavy currency spending appear to be a good bet not only for August, but for high holidays season too, as FX-volatility poses challenges for personal budget

Sources: ITI Capital, Bank of Russia, EIA

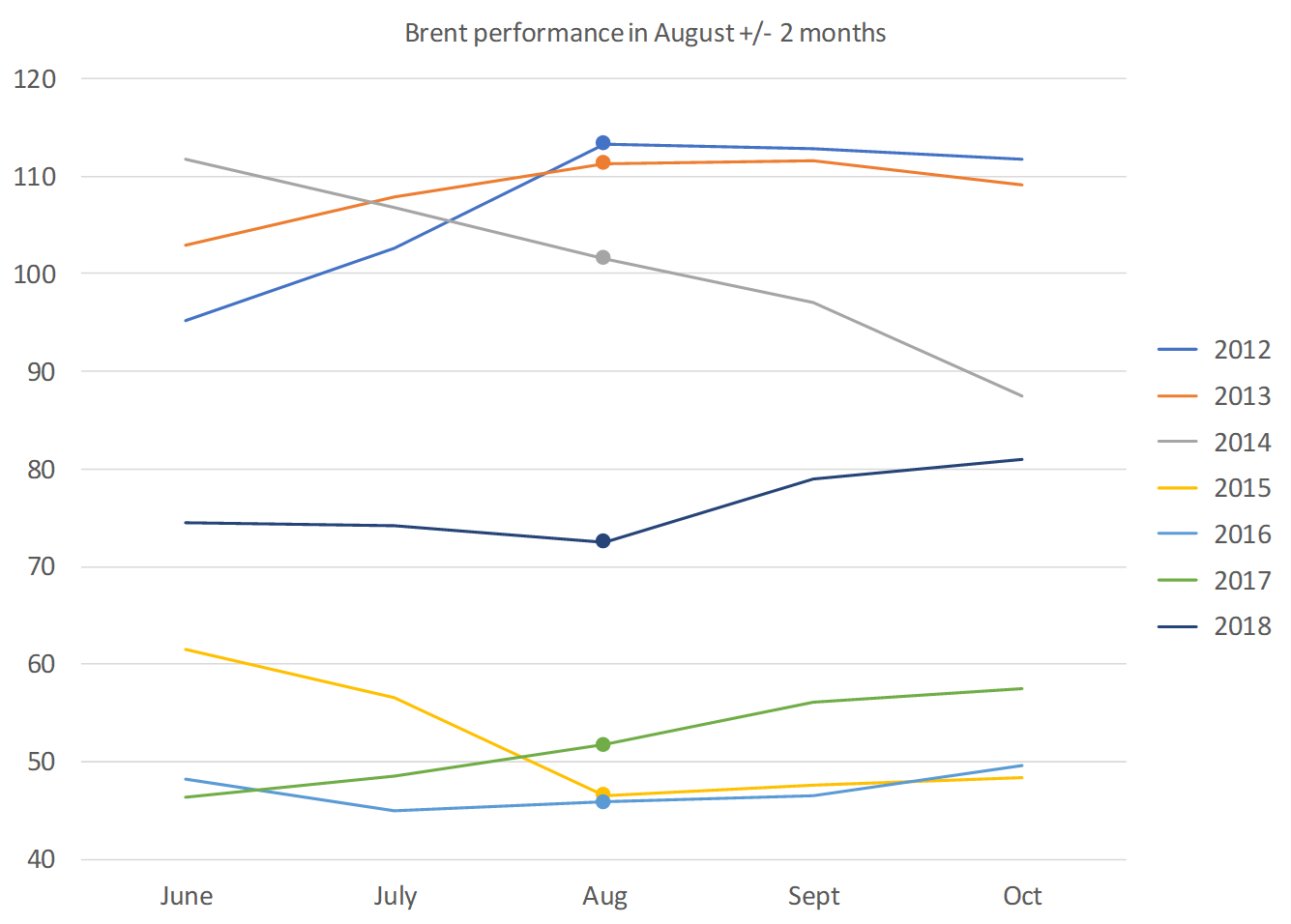

Oil

Despite Iran, oil retains downside bias given demand weakness. In August, Brent may fall to $61.5/bbl, in our opinion.

Sources: ITI Capital, Bank of Russia, EIA

Key events in August

- G7 summit

- U.S. — China talks