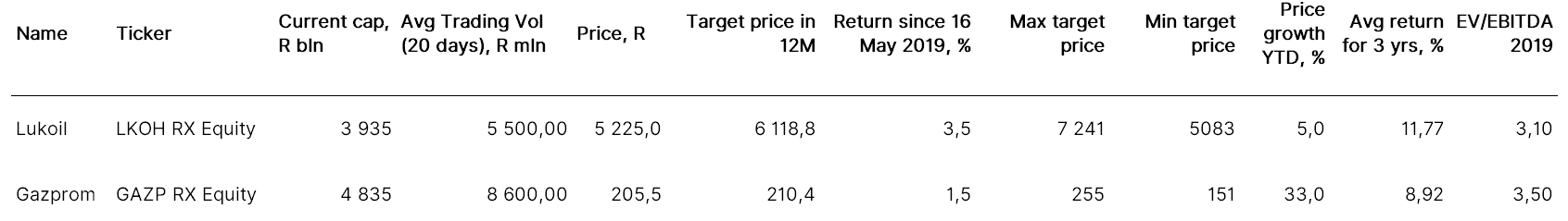

On May 16, we issued an idea of buying Lukoil (LKOH RX) with a 5,436 roubles price target through June. Since then Lukoil is up by 3.5%, while Gazprom gained by 1.4%.

We believe Lukoil looks undervalued technically and fundamentally unlike Gazprom that looks overvalued after the recent spike in prices. We believe that in the near term, Lukoil’s shares will approach the buyback price of 5,450 roubles and will climb further to the fundamental target level. We recommend BUY Lukoil and HOLD Gazprom.

*Lukoil BUY idea of May 16

Why Lukoil will rise further unlike Gazprom

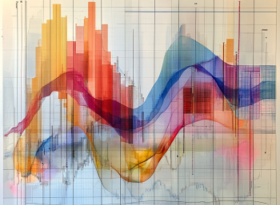

1) Lukoil, unlike Gazprom, looks more undervalued fundamentally. Its upside potential is 15.6% from now till the year’s end, based on the consensus price of 6,118 roubles. According to our estimates, the target price is 5,800 roubles or +10% from current price levels. The top range of consensus implies upside potential of 36%, based on the target price of 7,241 roubles, and downside potential is 14% (5,083 roubles).

The upside potential of Gazprom is largely limited — 1.5% from the current level, the consensus target price is 210.42 roubles, according to consensus. Based on the 255 roubles target price, Gazprom’s maximum upside potential is 28%, downside potential is 28% (151 roubles).

2) Foreign buying interest in Lukoil is strong, since non-residents account for a greater share of the company’s free-float (FF). For example, the investment funds’ share in Lukoil’s FF is 42% against 29% in Gazprom’s FF. At the same time, Lukoil has one of the largest depositary receipt programmes — about 40% of the capital share against Gazprom’s 24%.

3) Lack of near-term growth triggers from Gazprom. We believe that Gazprom’s shares will climb above 210 roubles and consolidate below 200 roubles — the market has priced in most of the dividend payout due to strong profit and there are no corporate events in sight to push the shares up.

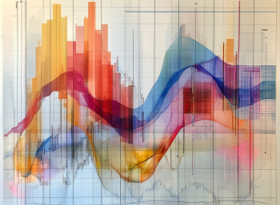

4) Technical indicators suggest that Lukoil shares are at the beginning of the growth cycle. RSI 14 days suggests that Gazprom’s overbought level stands at a record high of 79 p., that inevitably should result in a correction, our target level is 185 roubles.

It’s the other way around for Lukoil. 14-day RSI suggests the oversold level is 42 (level under 50 implies the shares are oversold) and, therefore, the upside potential is still strong — 6% through June and 10–15% until the end of the year.

Other important Lukoil’s strengths

- The new buy-back programme expected to be announced in September could contribute to further growth of the company's shares

- Lukoil’s enjoys one of the industry’s highest margin barrels in upstream. Lukoil's EBITDA for 2018 was $21.2/bbl, nearly two times that of Gazprom ($11.4/bbl), Lukoil's net profit was $11.8/bbl against $6.4/bbl of Gazprom. Lukoil's 2018 FCF reached $10.6/bbl against marginally negative FCF of Gazprom amid record investments

- In terms of EV/EBITDA multiples (based on EBITDA consensus for 2019 and 2020), Gazprom has already been trading higher than Lukoil (3.5—3.4x versus 3.1—2.8x, respectively), which is unjustified, in our view

- Greater resilience to sanctions due to smaller share of offshore oil projects

- Record FCF in O&G

- Strong financial results and potential for further growth if production restrictions under the OPEC + agreement in 2H19 are eased

Gazprom’s strengths

- Record dividend returns for 2018

- Natural monopoly

- Record profit for 2018

- Enjoys the benefits of the oil and gas sector

Gezprom’s short-term risks

2019 capital investments may top consensus of 1.33 trln roubles. (the company has often reviewed its annual budget in previous years), and export sales are unlikely to exceed last year’s figure (in January—April, supplies fell by 8.4% yoy) due to stronger competition in Europe’s LNG market, which will continue to put pressure on the company’s FCF.

The prospects of extension of gas transit contract with Ukraine and of Nord Stream-2 completion are still uncertain; new US bill sanctioning companies involved in Nord Stream-2 project poses risks to Gazprom.

LUKOIL — LKOH RX

GAZPROM — GAZP RX

Source: Bloomberg, ITI Capital