Global metal and mining sectors have tumbled over 15% since June, largely due to increased risks of economic slowdown amid escalating trade wars.

We believe that the market is overestimating the risks, and forecast demand to recover ahead of new U.S. — China trade agreements expected at the end of the third quarter.

The market will try to price in this factor in advance, which will clearly support the most undervalued stocks, first and foremost in the Russian metal sector — it shows strong financial performance despite negative effects from high volatility.

We believe Severstal and MMK have the highest growth potential among steelmakers due to the continued strong demand for steel products in the Russian market, which accounts the bulk of both companies’ sales (about 75% of Severstal's revenue and over 80% of MMK's revenue).

Severstal: Upside potential — 16%

- The most reliable business model due to availability of own raw materials, the highest share of high value-added (HVA) products among Russian metal makers and low production costs

- 12M upside potential — 29% (Bloomberg consensus), expected dividend yield — 13%

ММК: Upside potential — 24%

- Value multiples are significantly lower than those of peers (EV/EBITDA of about 3x compared to 5x of NLMK and Severstal) and lower than MMK average over the past five years

- The company will further benefit from the current decline in iron ore prices

- 12M upside potential according to Bloomberg consensus — 49%, expected dividend yields — 11%

Alrosa: Upside potential — 18%

- The company's stocks have dropped to the lowest since mid-2016 amid weak 7M19 sales and demand uncertainty throughout the rest of 2019 due to trade wars

- The current price implies a 34% upside potential, according to Bloomberg consensus, but there is a risk of the corresponding outlook downgrade

- The company will release 1H19 IFRS results on Monday, August 19; expected sharp decline in profits (by 35% yoy) may add pressure on the shares

- Projected 2019 dividend yield may decline from the current 15% to less than 10% if 2H19 net cash flow is weak

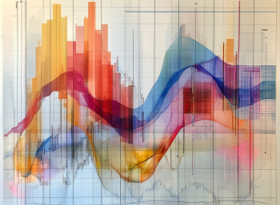

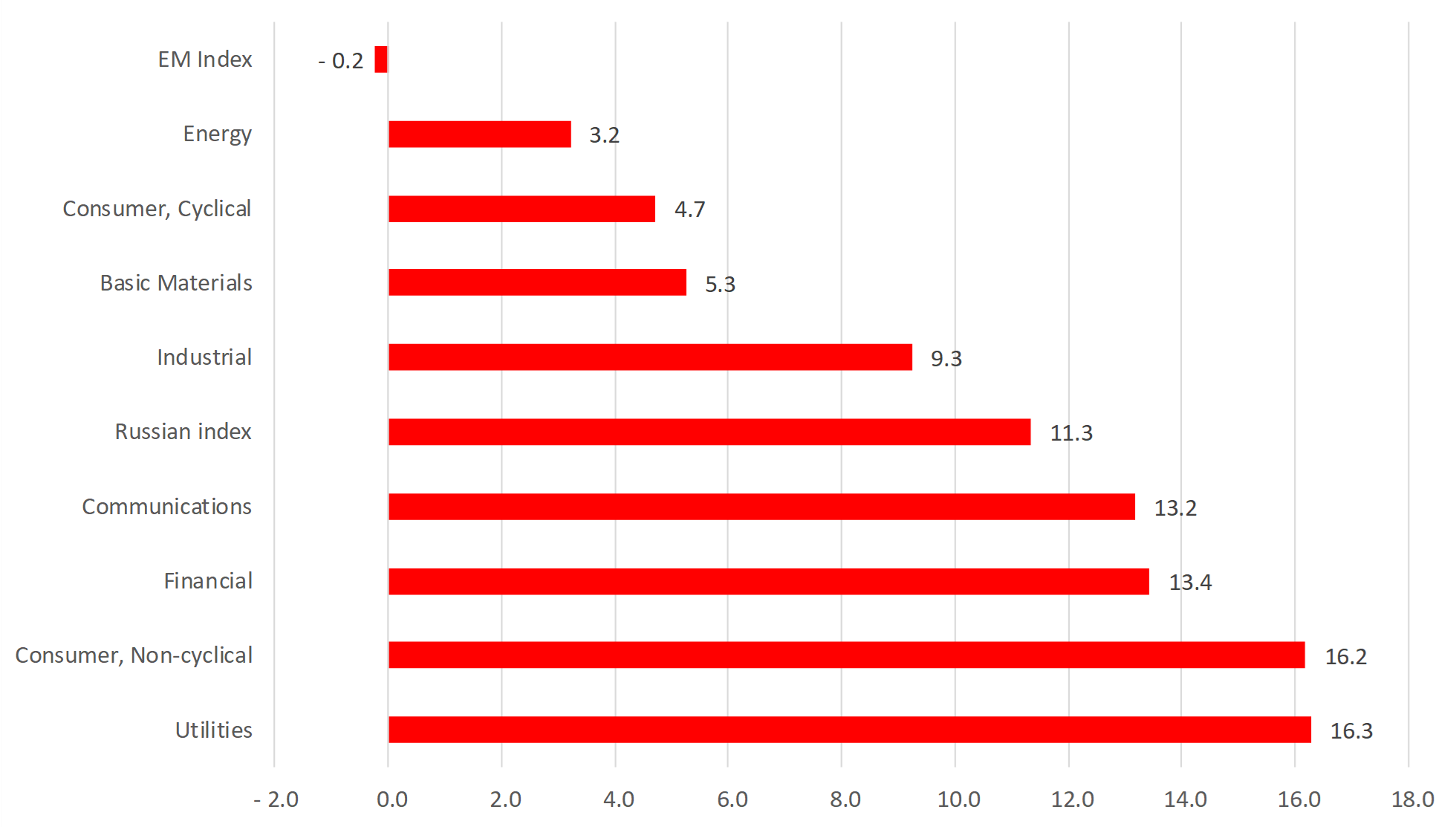

Major sectors performance, YTD, %

Source: Bloomberg, ITI Capital

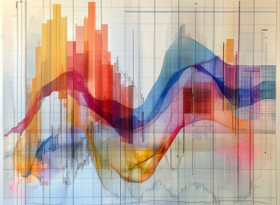

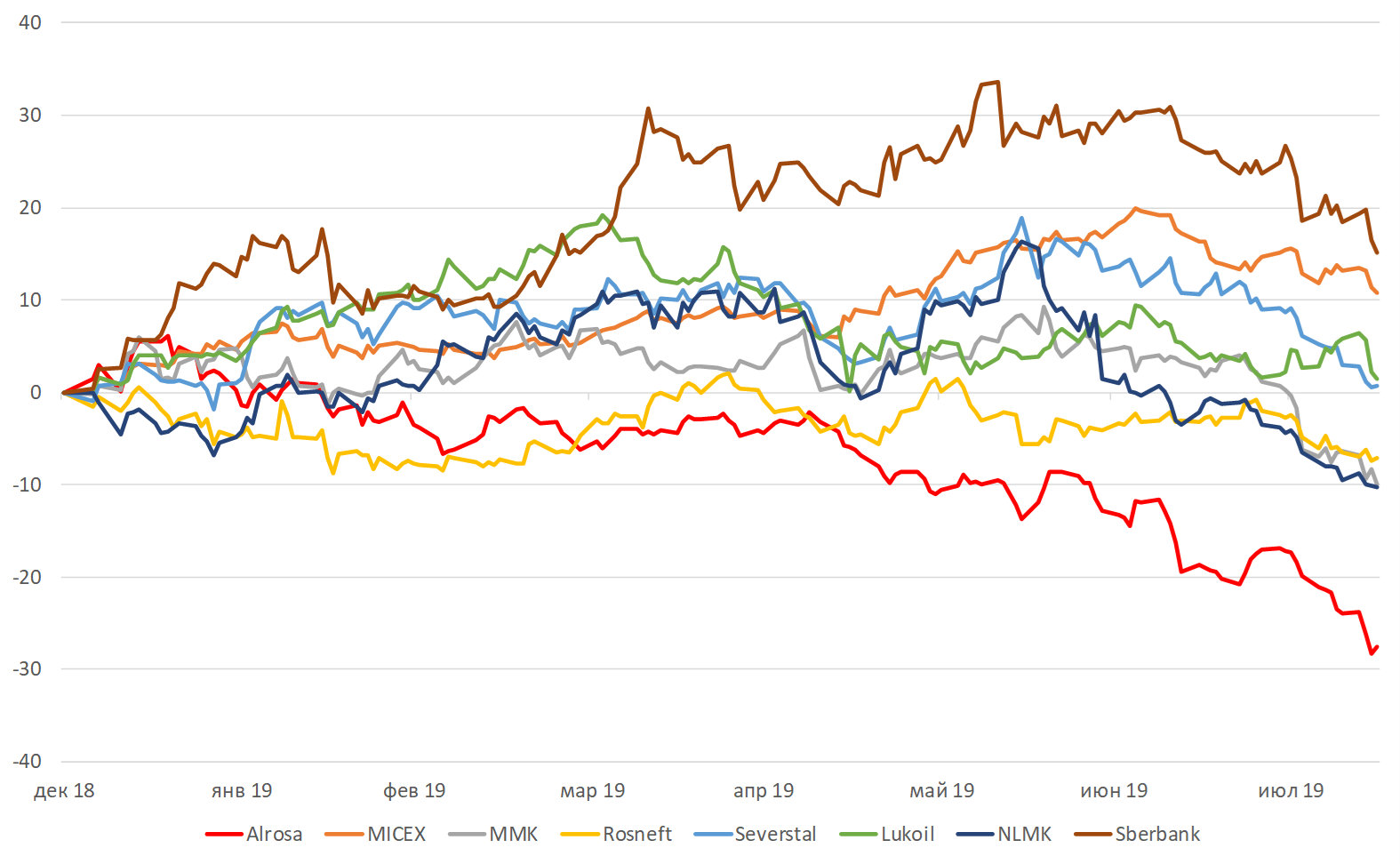

Stocks performance, YTD, %

Source: Bloomberg, ITI Capital