We think the Russia got off easily at least till end of the year. We do not expect further sanctions neither this year nor going forward, at least until the U.S. presidential on November 3, 2020. However, there might be some provocations during the presidential race in the third quarter of 2020. Any further sanctions will be tough by default — a ban to buy OFZs and Russian non-commercial banks (VEB) limiting transactions in US dollars.

A ban for U.S. banks and their international affiliates (accounting for over 50% of major investors) to participate in the primary market for non-rouble denominated sovereign bonds issued by Russia is the most important part of the announced package.

Given that the ban WASN’T priced in, we expect a correction in the Russian sovereign and quasi-sovereign dollar-denominated securities on Monday.

All in all, the Russian Finance Ministry will have to increase OFZ borrowings, but there’s no urgency — next year the state may tap the National Welfare Fund (NWF) (8 trln roubles, or $125 bln), which is on track to reach 7% of GDP due to MinFin’s FX-purchases over the past two years.

The head of the Bank of Russia suggests spending the liquid part of the NWF in excess of the 7% of GDP may result in «strengthening of the real rouble exchange rate and undermining competitiveness of the Russian products, adding to the vulnerability of the Russian economy to fluctuations in external environment».

The worst is behind in the medium term?!

The announced sanctions reduce the likelihood of a total ban on OFZs, which could have triggered a sharp drop in the rouble and other Russian assets.

Now, that a worst-case scenario didn’t materialize, we recommend increasing exposure to rouble assets and, over time, redirecting investments into foreign currency assets, which will recover in the medium term.

Our recommendation

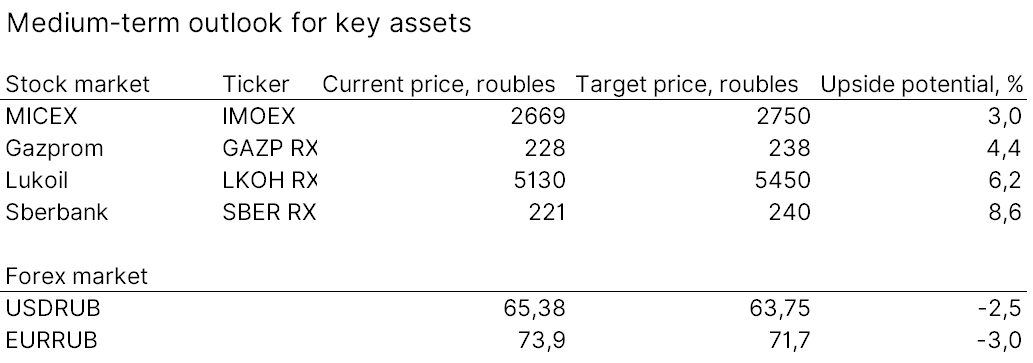

As soon as global volatility subsides, a good opportunity will emerge for buying the MICEX index and undervalued blue chips such as Gazprom, Sberbank, Lukoil. Next, we recommend to sell the dollar vs. rouble and buy short and mid-term OFZs. In the short term reduce exposure to foreign currency debt of the Russian issuers, including Gazprom and increase it after a short term technical correction, as demand in the secondary market will strengthen over time amid low supply in the primary market.

Sources: ITI Capital, Bloomberg