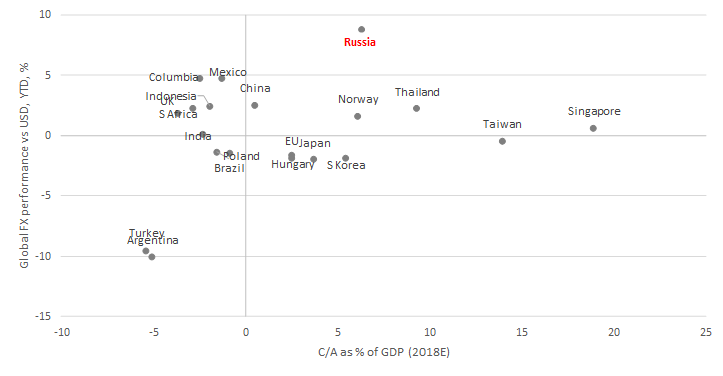

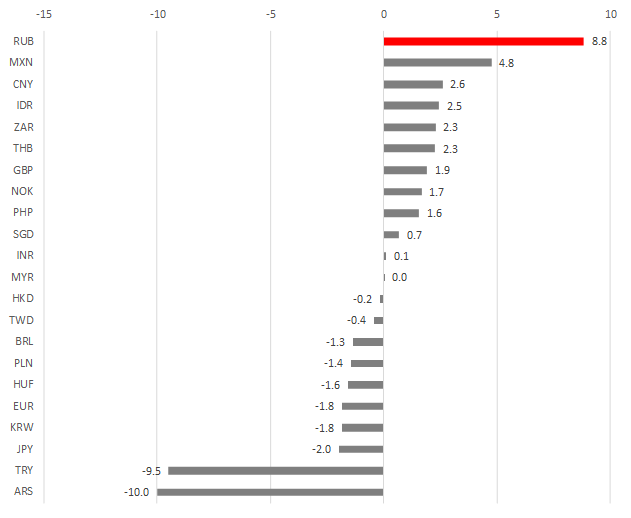

Russian rouble is the only global asset facing real sanctions risks apart from the Turkish lira that has strengthened against the dollar the most, vastly outperforming other currencies despite overheated markets. The history of cycles suggests correction is highly likely in May, and the largest FX-buying in 2019 will add pressure on the rouble. We believe that by the end of April, the rouble will consolidate at 64.20 and will continue to weaken to 65.15 in May. (50-day moving average). With fewer working days in May — June due to traditional public holidays, FX interventions will grow to 18% of the average FX-market turnover (the average daily trading volume in April fell to 2.1 bln a day USDRUB TOM). Assuming no sanctions looming and Brent trading at $74/bbl, the justified USDRUB rate is 65.

Excessive appetite for risk

- Most Russian assets have been in demand from both local players and foreign investors year-to-date. During the period, RTS climbed 19% in dollars, the rouble surged 9% against the dollar, sovereign eurobonds gained 5–6%, OFZ — 3–4%

- The dollar has been strengthening since March due to higher treasuries yields, reversing earlier weakness

- Russia has drawn investors too amid strong appetite for risk. Most of the assets, mainly EM FX-debt (especially high-yield), U.S. Stock market indices, such as S&P 500, and certain companies shares have approached local historical maximums

- Majority of key growth factors are priced-in and the market waits for new triggers. However, before they emerge, we will witness a short-term technical correction in May

Rouble risk premium has shrunk to 60% YTD

- USDRUB has hit new lows since 8 August 2018. Back then, the U.S. has doubled tariffs on metal imports from Turkey, issued a first round of sanctions against Russia related to the U.K. Attack and announced a second set that hasn’t been rolled out though as yet

- It is little wonder, that the rouble has been quietly erasing a 12 roubles premium, since Rusal designation in April 2018. The current country premium is already down to 5–6 roubles, or 40% of what it used to be. Importantly, the country risk premium on the Russian FX denominated debt is 0 bp, while the premium on the rouble debt market remains the highest across all Russian assets — 100–130 bps.

Why the rouble strengthens against the dollar

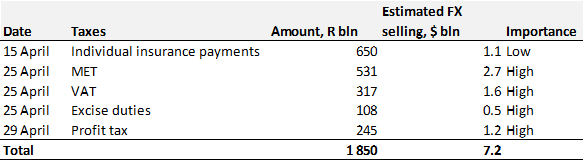

Further USDRUB support levels are 63.4, 63.15 and 62,70 (200-day moving average). Now the market heavily relies on two external factors. First, the global demand for risky assets, which is steadily growing despite many assets prices reaching their highs. For example, oil prices remain strong due to geopolitical uncertainly and a temporary supply drop. Secondly, a local technical factor that works for the rouble are substantial tax payments that will amount to 1.9 trln roubles, according to our estimates. Hence, the companies could sell $7 bln for tax purposes. With the bulk of payments scheduled on 25 — −29 April, the rouble will be able to remain within a narrow range of 64-64,20.

Why the rouble will tumble in May?

- From May 14 to June 6, Minfin’s FZ-buying will amount to 380 bln roubles, or $ 5.9 bln, a rise of 54% against purchases in April 5 — May 13, our estimates suggest. With fewer working days in May — June due to traditional public holidays, FX interventions will grow to 24.3 bln roubles a day ($376 mln). Since average trading volume on the stock exchange decreased and may go down further in May, MinFin’s daily purchases may reach 15-20% of the daily FX-market turnover, a rise of 70% against 14.2 bln roubles in March-April ($219 mln)

- With account of 56 bln roubles of suspended purchases, total FX-buying in May is expected to reach 436 bln roubles ($7 bln), or 20% of the daily FX-market turnover

- Besides local factors, a correction expected in May (sell in May and go away) is important, given that global asset prices have been rising on the overheated markets year-to-date

- Assuming no sanctions looming and Brent trading at $74/bbl, the justified USDRUB rate is 65. Tough sanctions against primary OFZ market will send the rouble to 70 and higher

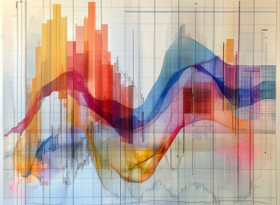

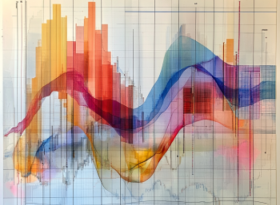

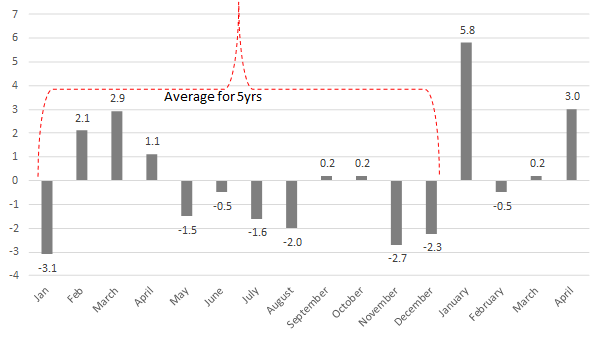

USDRUB performance, %

Source: Bloomberg, ITI Capital

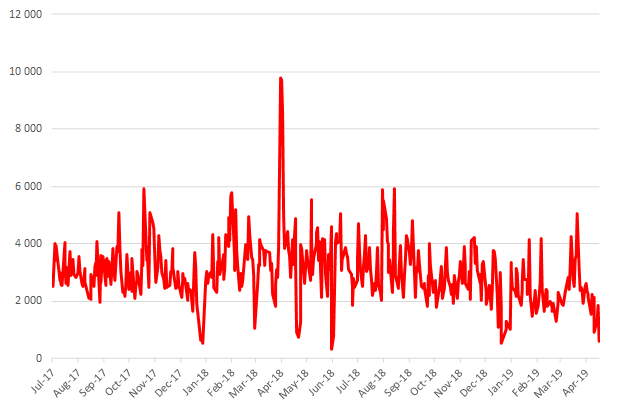

Daily trading volume on MICEX (USDRUB TOM), mln $

Source: Bloomberg, ITI Capital

Expected tax payments, R bln

Source: ITI Capital

The rouble looks excessively strong even against fundamentals.

Source: Bloomberg, ITI Capital

Global currencies against dollar YTD

Source: Bloomberg, ITI Capital