RUBUSD saw the biggest monthly drop in five years, tumbling 4.4% in August, as emerging markets volatility due to the U.S. — China trade wars fuelled demand for protective assets (gold, Japanese yen) and flight into dollars, and prospects of Argentina’s default increased following President Mauricio Macri’s rout in primary elections over the weekend. Peronist opposition candidate Alberto Fernandez, a former cabinet chief, dominated the primary vote by a much wider-than-expected 15.5 pp margin over the president. The rouble looks solid in August compared to its peers: the Argentine peso lost 19%, the South African rand —5%, the Brazilian real and the Indian rupee also declined. Haven currencies such as the Japanese yen (+1.6%) have been the top-performers, outstripping the dollar.

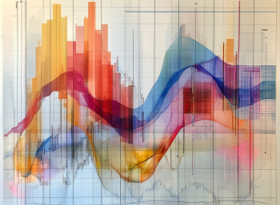

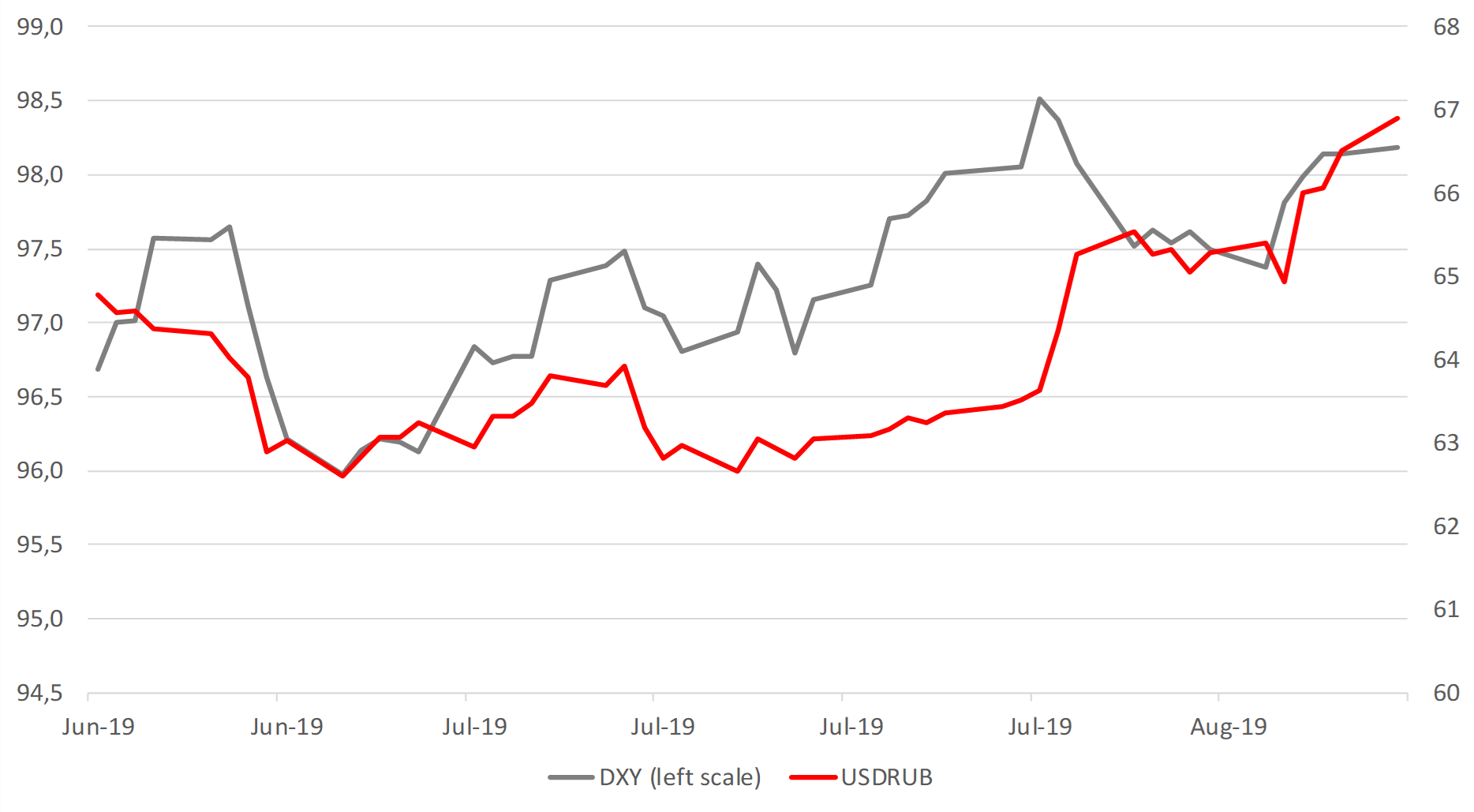

Stronger dollar has been largely driving the rouble’s performance

Source: Bloomberg, ITI Capital

Stronger rouble scenario — top picks

- Sberbank with a 232 roubles (50-day moving average) short-term target price is the most appealing stock. Metal and mining stocks outlined in our recent note also look attractive

Stronger rouble — global drivers

- The Fed's minutes from its July policy meeting are set to arrive on August 21, the Fed chairman Jerome Powell is scheduled to speak on August 23 at the Economic Policy Symposium. Markets will be watching for signs of a new easing cycle — the first rate cut is expected as soon as September, the next one — in December

- Stimulus measures from countries across the globe including EU (above all Germany) and China raise the prospect of economic recovery in the coming months after the weak first half of the year

- Trade-war triggered volatility peak is behind us now, and a U.S. — China deal may be reached as early as mid-September

- Oil rebound

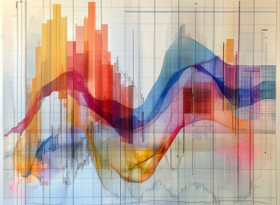

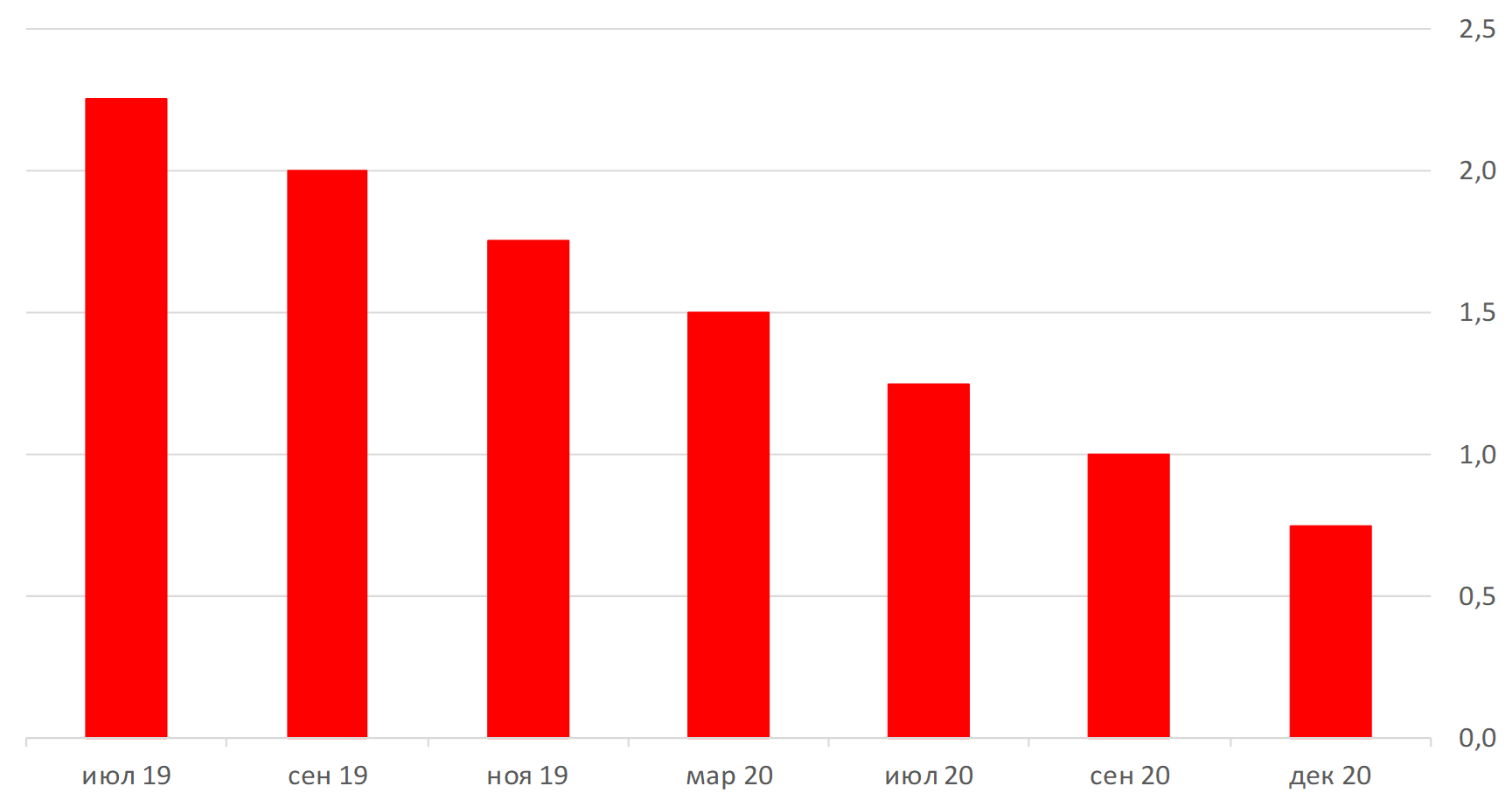

Fed rate cut outlook (market expectations)

Source: Bloomberg, ITI Capital

Stronger rouble — local drivers

- 750 bln roubles of tax payments in 26–28 August

- Brent recovery to 63.91/bbl. (200-day moving average), up 7% from now

- Limited FX-buying in September — about 220 bln roubles amid cheap oil in August

USDRUB technical levels

- Decline in oil and the rouble reflects demand for risk and is not related to market fundamentals. Key USDRUB resistances are 66, 65.34 (200-day moving average) and 64.38 (100-day moving average)

- The current RSI implies the USDRUB is significantly overbought — by 73 p., the level traditionally signalling the start of a U-turn and the rouble’s rebound

- The rouble's correlation with oil increased to 45%, as Brent prices approached $50/bbl Urals, and $52 Brent, the critical threshold for the Russian budget