Our investment idea for Sistema's shares has returned nearly 15% since its opening on 13 September 2019 and topped our year-end $5.8/GDR projection. We’ve upgraded our Sistema valuation due to recent changes. Our new estimated price for Sistema is $5.8/GDR with an investment horizon till the end of 2020.

The main triggers of the group's stock growth remain the same:

- Revaluation of Sistema's non-market assets, with Ozon being the main driver amid market position strengthening and an IPO potential in 2020

- Reduction of the corporate centre’s debt — to $3.3 bln from $3.4 bln as of 1H19

- IPOs of other non-market units within the next two-three years — Agro Holding Steppe, Medsi, Segezha Group; three good-looking companies are industry leaders, outpacing their peers

- Moreover, Sistema's shares are supported by a buy-back programme launched in September

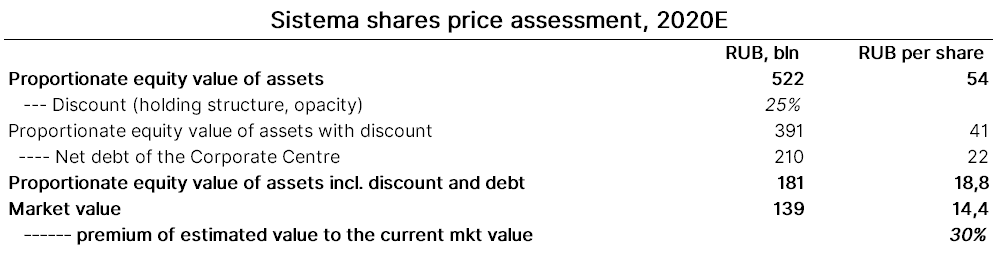

We raised the group's market and non-market assets’ valuation (by a total of 11%, or $783 mln based on the group's proportionate shares in its assets) from the previous assessment. In particular, Ozon's valuation was up 12% to $925 mln excluding debt. We also downgraded the estimate for corporate centre's debt from $3.4 bln to $3.3 bln in line with our understanding of gradual debt reduction by the group, to $2.2–2.4 targeted by the management in mid-term. Our new estimated Sistema price is $5.8 per GDR with an investment horizon till the end of 2020.

Source: Company data, ITI estimates