Bottom line:

Assuming that tougher sanctions against Russia are no longer looming, Russia’s investment-grade local debt and sovereign local debt (OFZ) seem like the most appealing investment targets now. The current premium of many quasi-sovereign securities (Rosneft, Russian Railways, Gazprom) to the OFZs on the short and medium curve is 2.5 times (about 100 bps) higher that the minimum (30-50 bps) for the last couple of years. However, the OFZ yields may go down back to the levels seen in April 2018 dropping by 100-130 bps in line with the yields of FX-sovereign debt and many USD corporate issues except for several banking placements (for example, VEB and Alpha perp). Our main point is that unlike USD Russian Eurobonds, high grade local issues and OFZs, trade at high country risk premium.

To date, country risk beta for rouble bonds remains high in contrast to the FX-debt market due to several reasons: high local risks, tight liquidity, still hawkish market expectations of a rate cut (not sooner than the end of 3Q2019) and excess supply of new sovereign debt issues (over 650 bln roubles in March, the highest on record).

OFZs and corporate debt still behind the curve

Year-to-date, demand for most Russian assets, except for rouble-denominated corporate bonds, has been generated by both local players and non-residents. During the period, RTS climbed 19% in dollar terms, the rouble surged 9% against USD, sovereign Eurobonds gained 5–6%, OFZ — 3–4%. The prices for another key asset, rouble-denominated corporate debt, in contrast to corporate FX-debt advanced only by 2-3%, while the corporate debt in USD surged 5–6% on average, approaching the highs of April 2018 (prior to sanctions against Rusal). Hence, the countries market beta for foreign debt is now zero against 40-50 bps (sovereign debt level) in early April 2018 when SDN sanctions against Rusal were announced. On the other hand, the country rouble premium (OFZ) is over 100 bps. High grade corporate rouble debt looks even more attractive, as the premium to the OFZ curve is at all-time high.

OFZ: Huge untapped potential

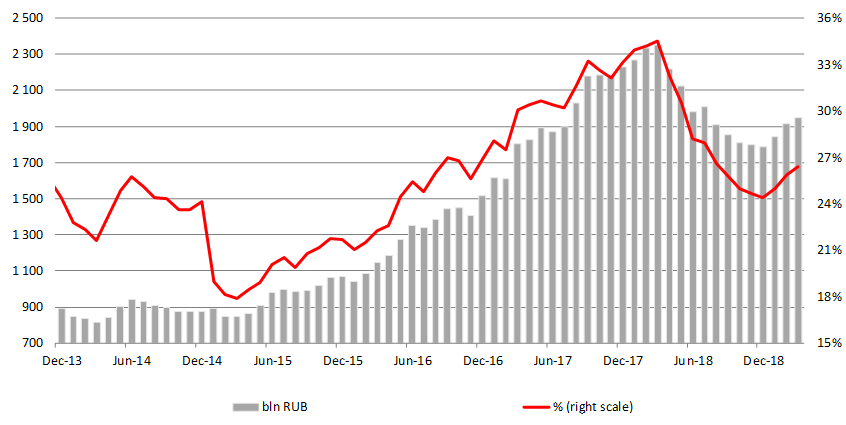

- In Q1 2019, the OFZ market on the medium and long curve attracted most of foreign capital inflows, according to CBR’s Monetary Policy Report for Q1. In January, February and March, foreign investors bought 64 bln, 88bln and 97 bln roubles of OFZ respectively. New wave of sanction speculations in mid-February partly suppressed non-residents appetite, but didn’t trigger a significant outflow of foreign funds, as was on previous occasions

- Besides the global demand for risky assets, Russia’s MinFin decision to scrap limits for OFZ auctions has contributed to a rise in foreign OFZ holdings. It resulted in record February and March new OFZ placements, triggering a strong inflow from non-residents in the equivalent of 249 bln roubles, or $4 bln. This amount partly offset previous foreign capital outflows back in April-December 2018. Hence, the net outflow from non-residents has shrunk from 561 bln roubles ($9 bln) since April 2018 to 312 bln roubles ($5 bln), bringing non-residents’ share above 26% (the levels seen in late August 2018), a rise of 2% from December lows

- The inflow is similar to Q12017, but at that time there were no new sanctions announced and other geopolitical risks from the United States

- However, despite strong demand for the OFZs, spreads are little changed. The OFZ curve is trading at a 50-bps premium to CBR’s key rate, despite moderate inflation growth and expectations of a key rate cut before the year-end. Traditionally, OFZ yields lag behind those of the key rate that reflects both money market risks and counterparties’ risks which by default is higher than that of sovereign debt

Why there’s still a premium in the OFZ yields?

- To date, investors have paid for country risk premium in FX in full, but not on the rouble bonds market, due to several reasons: high local risks, tight liquidity, limited market expectations of a rate cut and a record supply by MinFin

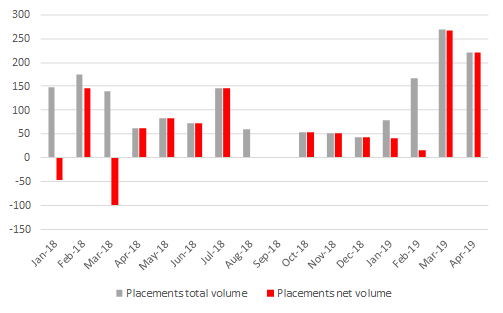

- Besides non-residents, strong demand has been generated by local investors such as banks deemed too big to fail. Total placements on the primary market was 513 bln roubles (net 503 bln roubles), an all-time high of the OFZ market

- Hence, non-residents and local investors shares were 56% and 44% respectively. However, in certain months, in particular in March, non-residents share was marginally over 40%

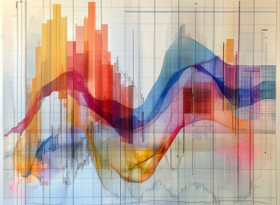

Non-resident OFZ holdings

Source: CBR, ITI Capital

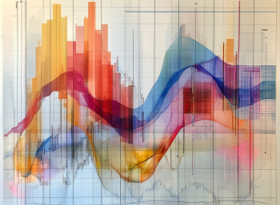

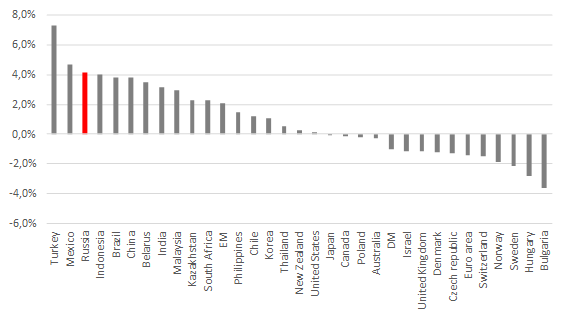

Global real rates, % (Russia is on Top-3)

Source: Bloomberg, ITI Capital

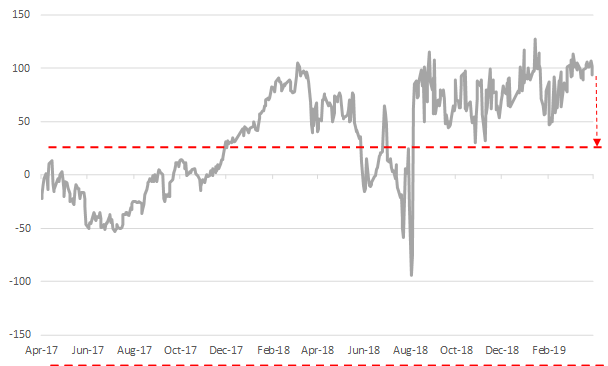

Spread between OFZ 2029 and CBR key rate, bps

Source: Bloomberg, ITI Capital

OFZ placements, bln roubles

Source: Bloomberg, ITI Capital

What are the buy options and where is the upside potential?

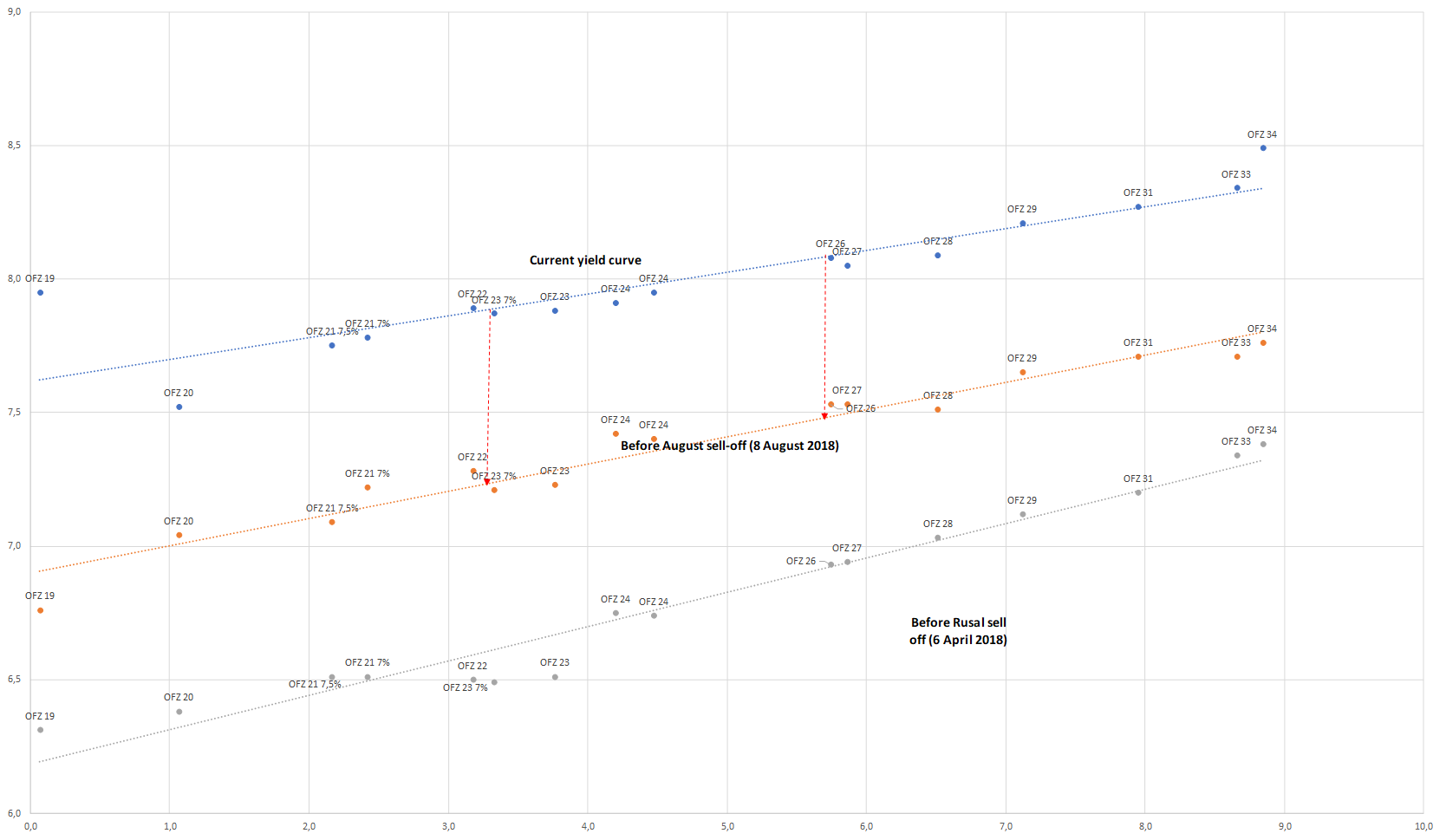

- OFZ price on the short curve rose by 2.5%, on the long — by 3–4%. The short curve yield (OFZ 2022) was little changed, dropping from February 14 high of 8.2% to 7.75%. The long curve yield dropped by 30 bps, to 8.2%, from 8.5% high. If we leave aside the effects of sanctions against Rusal and take the yield curve prior to this shock, the yield downside potential is 100–130 bps from now. Back then the key rate was as low as 50 bps, but expectations of further key rate cuts were much higher

- Hence, the spread between the yield of the long and the short OFZ curve remains at 35 bps (2018 average), which is a decent level, against 52 bps in April. The average is about 20 bps. We expect a steeper yields’ drop on the short curve due to the recent CBR’s decision to ease monetary and high chances of a rate cut in September

- Based on the OFZ’s upside, we believe sovereign bonds are undervalued. We recommend OFZ 22 (RU000A0JXB41), OFZ 21 (RU000A0JVW30) and OFZ 27 (RU000A0JS3W6)

Spread between the long and short curve, bps

Source: Bloomberg, ITI Capital

Why corporate issues look more appealing?

- Quasi-sovereign corporate investment grade securities have the biggest upside potential. The spread between them and the OFZs is little changed and remains wide, despite the fact that corporate securities yields have followed those of the OFZs and are now back to the average of September—December 2018. The upside potential of the high-yield and riskier issuers is largely limited

- For example, the spread between Rosneft 23 rouble bonds and OFZ 23 is 100 bps against two-year average of 35 bps. Russian Railways and Gazprom securities are trading at a similar premium. When it comes to the same duration, the spread between the rouble debt of Sberbank and OFZ was 52 bps at the peak in March against 30 bps now, though at a certain point the spread was negative given lower Sberbank yields

- Therefore, the spread between local corporate securities and OFZs is much wider than that between the Sovereign Eurobonds and $ corporate Eurobonds that remains within 40–50 bps range along the entire curve. When it comes to the rouble notes of the state-owned companies such as Gazprom, the spread at the long end is 70–80 bps against 30 bps on average

- When it comes to the high-yield bonds, such as O'Key, the premium to the OFZs exceeds 180 bps against 150 bps on average, which implies a limited upside potential, in contrast to quasi-sovereign debt

- We recommend buying short and mid-term securities of state-owned companies (adjusted for put-options) against OFZ, while the premium of high-yield securities remains within the range

- The main reason behind elevated high grade corporate yields is a slow decline in OFZ yields

- We believe that this will not last long, we expect the spreads to narrow due to faster decline of corporate securities yields

- The demand for corporate securities may pick up, as the issuers will seek to replace corporate currency securities with rouble-denominated debt in the new placements. As a result, the volume of rouble loans to non-financial organizations may surge too in line with the trend that started in March, following a moderation in the rouble loans growth

- The replacement of FX loans with rouble-denominated ones continued, with the annual growth of rouble loans to non-financial organisations amounting to 12.1%, and the annual reduction of FX loans standing at 10.3%, CBR’s reports says. Over the first six months of this year, we can expect a certain recovery in the corporate segment of the lending market, given the continued dedollarisation of this market segment, it says

Spread between medium duration corporate bonds and the OFZs, bps

Source: Bloomberg, ITI Capital

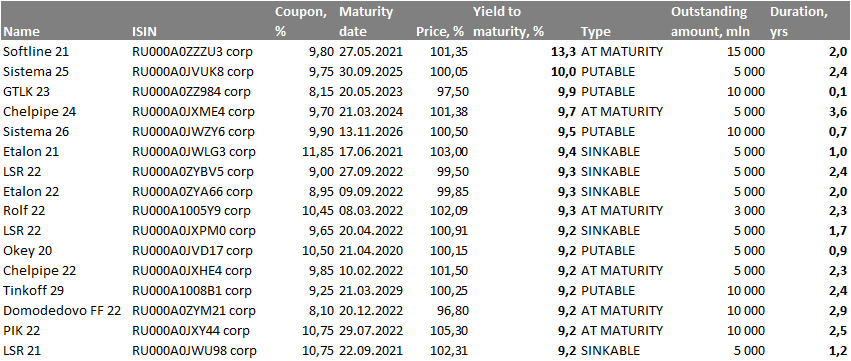

Our top recommendations:

High-yield corporate rouble issuers

Source: Bloomberg, ITI Capital

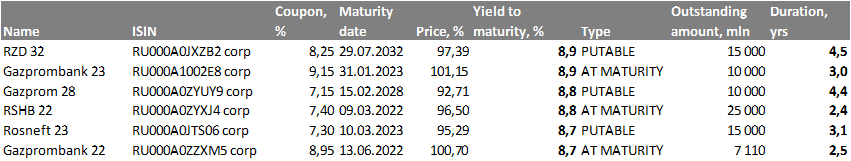

Low-risk rouble issuers

Source: Bloomberg, ITI Capital

Sovereign rouble bond yield curve

Source: Bloomberg, ITI Capital