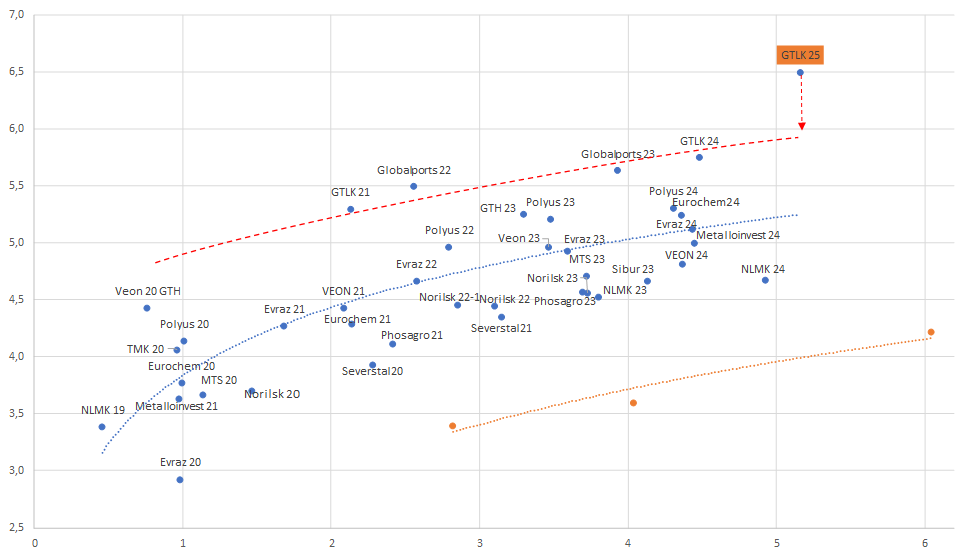

State Transport Leasing Co. (GTLK), Russia’s largest leasing provider, is selling 6Y dollar-denominated notes. With IPT of 6.375–6.5% and the premium to the curve of 0.47–0.65 bps, the issue looks attractive. That implies potential 1.5–2% upside in price at the time of placement.

We believe GTLK will sell $500 mln, in line with previous placements. STLC has two outstanding Eurobond issues for $500 mln each.

- On the price side, GTLK Eurobonds outstripped other Russian corporate dollar-denominated issues surging 6%. GTLK eurobonds performance has been the most sustainable among other securities

- State ownership is GTLK’s major advantage

- However, the company’s debt is as big as 402 bln roubles. ($6 bln) as of 2018, its debt/EBITDA ratio is one of the highest among Russia’s corporates (above 10x)

About the company

GTLK/State Transport Leasing Company is the largest leasing provider in Russia. Its principal activities are the leasing of air transport, sea and river vessels, railway vehicles, trucks and special equipment as well as energy-efficient urban passenger transport, including gas and electricity propelled vehicles.

The sole shareholder of the company is the Russian Federation represented by the Ministry of Transport.

STLC’s total portfolio was $14 bln as of 31.12.2018.

STLC has BB category credit ratings from all three leading international rating agencies, and A+(RU) national scale rating from ACRA.

Russian corporates — dollar eurobond curve