Overnight Snapshot

The Day Ahead

0830hrs UK EU The ECB Supervisory Board Chair Daniele Nouy speaks in Ljubljana

0845hrs UK EU ECB Governing Council Member Ewald Nowotny speaks in London

0930hrs UK US Dallas Fed President Robert Kaplan speaks in Beijing

1030hrs UK UK Bank of England MPC Member Andy Haldane speaks in Melbourne

1100hrs UK EU OECD Eurozone Leading Indicator (previous 100.2)

1330hrs UK US PPI Final Demand (est 0.11%mom/2.88%yoy vs previous 0.2%/2.8%)

1500hrs UK US Wholesale Inventories (est 0.76% vs previous 1.1%)

1630hrs UK EU ECB Governing Council Member Ignazio Visco speaks in Rome

2330hrs UK US Atlanta Fed President Raphael Bostic speaks in Massachusetts

0200hrs UK CN For the nightbirds, PBOC Governor Yi Gang speaks in Hainan

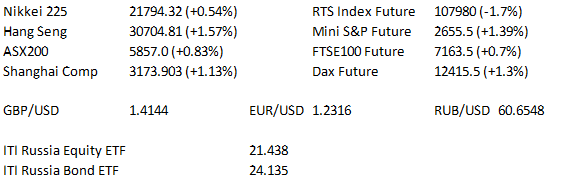

The Day So Far….

STOCKS: Wall Street’s major indexes jumped more than 1 per cent in early trade yesterday as tech stocks rebounded and a softer stance by US policy makers on China tariffs fueled a rebound from last week’s sell-off. Led by the tech stocks, 10 out of 11 S&P sectors were higher, although gains were given back in to the close as President Trump entered the Twittersphere with notes on an FBI raid on his lawyer’s office.. The SPX ended nearly 9 points up at 2613.16 after trading as high as 2653.55. The Dow suffered mixed fortunes too, closing up 46.34 at 23979.1 after earlier gains of close to 350 points saw 29 of the 30 components printing gains. Bucking the trend, the RTS futures on Russia’s leading stocks has taken a hammering as investors worry if the fresh US sanctions on certain Russian names will bring widespread doom to Russian equities.

Stock futures and Asian stocks jumped after Chinese Pres. Xi delivered a very measured message stressing that China wants to promote global multilateral free trade. Any criticism of the US was very modest & indirect. - The Nikkei 225 added 1.1% in the morning session as all sectors moved higher, materials & industrials led the way higher, while consumer staples were the main laggard. - Hong Kong's Hang

Seng traded 0.9% higher in the morning session and has added further gains in the afternoon. The mainland Shanghai Composite has also added around 1.0% and trades near the highs as they approach the close- Australia's ASX 200 traded in a straight line to the highs around mid session before trading sideways for the rest of the day. - US stocks surged on the Xi headlines with the e-mini S&P adding 35 points & the mini Dow adding over 300 points.

US TSYS: US Tsys have moved lower as Chinese Pres. Xi has delivered a very measured message stressing that China wants to promote global multilateral free trade. Any criticism of the US has been very modest & indirect thus far. - The space stuck to a tight range early on, supported by the risk off flow that was evident in late US dealing after reports hit revealing that the FBI has raided the office of Pres. Trump's long-time lawyer Cohen. - The Eurodollar strip has also moved lower, with the white & red contracts 0.5-2.5 ticks lower.

OIL: Crude futures legged higher following early losses in Asia-Pacific dealing after President Xi delivered a China is open message & pointed to a want for multilateral free trade agreements, which put a bid into risk assets. Crude futures benefitted as Xi vowed to open sectors from banking to auto manufacturing, increase imports, and lower foreign ownership limits

GOLD: The yellow metal moved away from Monday's best levels as risk on flows weighed on gold after Chinese President Xi’s speech. Gold last trades at $1334/oz.

FOREX: Risk assets benefitted as Chinese Pres. Xi delivered a very measured message stressing that China wants to promote global multilateral free trade, while any criticism of the US was very modest & indirect. This was after commodity currencies has moved back from Monday's best levels & JPY rallied as equities pared most of their gains in late US dealing as a report hit revealing that the FBI has raided the office of Pres. Trump's long-time lawyer Cohen. - Japanese exporter offers in USDJPY helped to cap the Xi-inspired move higher in JPY crosses, with talk of offers layered in above 107.30 up to 107.50, with the pair last trading around its 55-DMA (107.13). - AUDUSD cleared the 21-DMA (0.7716) & Apr 04 high (0.7727) on the back of Xi's comments, peaking around 0.7740, aided by AUDJPY bettering resistance at 82.70, although the Aussie has moved back from best levels. NZD & CAD also gained vs. USD but lagged the AUD. - GBP & EUR stuck to their tight ranges vs. USD.

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk