Overnight Snapshot

The Day Ahead

0930hrs UK EU ECB Governing Council Member Ewald Nowotny speaks in Vienna

0945hrs UK EU ECB Executive Board Member Benoit Coeure speaks in Paris

1000hrs UK EU EuroZone Trade Balance (est €20.27bln vs previous €21.2bln)

1000hrs UK EU EuroZone CPI (est 0.5%mom / 1.87%yoy vs previous 0.3% / 1.2%)

1000hrs UK EU EuroZone Core CPI (est 1.1%yoy vs previous 1.1%)

1330hrs UK US Empire Manufacturing Index (est 19.1 vs previous 20.1)

1415hrs UK US Industrial Production (est 0.17%mom vs previous 0.7%)

1415hrs UK US Capacity Utlization (est 78.04% vs previous 78.0%)

1500hrs UK US University of Michigan Sentiment Index (est 98.47 vs previous 98.0)

1600hrs UK EU ECB Governing Council Member Jan Smets speaks in Brussels

1800hrs UK US Baker Hughes Rig Count (est 1065 vs previous 1062)

1830hrs UK US Dallas Fed President Robert Kaplan speaks in Fort WOrth

No major earnings releases today. Tesco to publish a trading statement.

HEADLINE NEWS:

ECB CALLS TIME ON QE

: UNILEVER ALMOST CERTAIN TO EXIT FTSE100

: TRIPLE WITCHING TODAY WITH MULTIPLE FUTURES & OPTION EXPIRIES

The Day So Far….

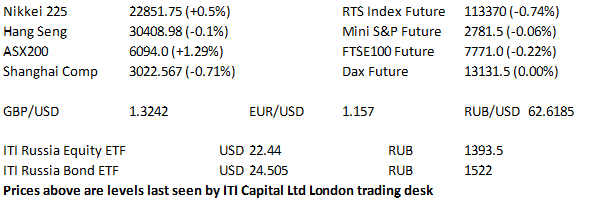

STOCKS: The S&P500 edged up whilst the Nasdaq100 printed an all time high yesterday after the ECB said it would avoid raising interest rates until the middle of next year, and data released in the US showed economic strength. The strong US retail sales numbers came the day after the Federal reserve had increased rates and hinted at 2 more hikes by year end. The ECB also announced it would end it’s bond purchase programme this year whilst signaling that any interest rate hikes were in the distance. The S&P500 closed up 6.86 points at 2782.49 with 7 of 11 sectors gaining, although rate sensitive financials were the biggest loser. The Nasdaq100 printed an all time high at 7291.306 before closing at 7279.59, higher by 74.336 points. The Dow however bucked the positive trend, closing 25.89 in the red at 25175.31 with United Health and Disney showing good gains whilst a number of the leading names printed negative, with JP Morgan the biggest loser, wiping over 13 points from the index on their own.

Asia-Pacific stocks traded in mixed fashion, but were higher in the main. The ASX200 added over 1.0% as telecoms led the charge, although gains were broad based, with all of the major sectors higher on the day. Elsewhere Japan's Nikkei lodged gains of over 100 points as the energy sector, alongside health care, pushed the index higher, with materials adding the most weight. Hong Kong's Hang Seng was more mixed, straddling the unchanged level throughout the day, with gains aided by health care and IT names, although telecoms weighed. The Shanghai Comp, lost over 1.0% in the morning session, and was on track for the largest run of weekly losses in 2018, as trade war worries weighed.

- US index futures were largely unchanged, with Mini S&P bouncing off the unchanged line a few times overnight, and currently 1.75 points lower at 2781.5 (September contract) and Mini Dow following the same pattern, trading 40 points lower at the time of writing.

US TREASUYS: US Tsys pushed higher as T-Note futures broke Thursday's highs, underpinned by media reports noting that the US is ready to slap tariffs on $50bln worth of Chinese goods, while this isn't particularly new it was enough to weigh on risk appetite, particularly when coupled with WSJ reports suggesting that China is ready to retaliate to the tariffs. - Tsys are back from best levels, but yields are still lower on the day, with 7-Year paper outperforming. - The Eurodollar strip is a touch flatter. JGBS: JGBs are bid in early afternoon dealing, playing catch up after the BOJ downgraded its inflation assessment. Futures have made new highs but still operate within a 10 tick range, while the cash curve is flatter as the super-long end leads yields lower. - The BOJ left its monetary policy settings unchanged as expected, but JPY has been on the back foot after the BOJ downgraded its view on inflation, some had suggested that this could happen. There was no change elsewhere, with an 8-1 vote, and Kataoka the lone dovish dissenter as ever.

OIL: The major oil metrics traded either side of flat for the majority of the session after Saudi Arabia & Russia pledged to come to a comprehensive bilateral energy agreement, with Saudi energy minister Al-Falih suggesting that it's "inevitable" the cartel and its allies will decide to boost output gradually, when he spoke on Thursday.

- Traders await the latest weekly Baker Hughes rig count print. WTI futures currently 4c higher with Brent futures unchanged

GOLD: The yellow metal has stuck to a tight range operating north of $1300/oz for the entirety of the session. August futures have been in the red all day, currently $5.5 lower at $1302.80, but still holding above the $1300 support

FOREX: The USD continued its grind higher in a holiday thinned session.

- The USD outperformance came despite media reports noting that the US is ready to slap tariffs on $50bln worth of Chinese goods, while this isn't particularly new it was enough to weigh on risk appetite, particularly when coupled with WSJ reports suggesting that China is ready to retaliate to the tariffs. In terms of the majors, the commodity linked currencies bore the brunt of the pressure stemming from these headlines. - The JPY had been outperforming, but the JPY gave up most of its gains (with USDJPY turning marginally positive) as the BoJ downgraded its view on inflation.

Please contact ITI Capital London trading desk on dealing@ITICapital.com for further information or updates

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk