Overnight Snapshot

The Day Ahead

0910hrs UK UK The Bank of England’s Sarah John speaks in Liverpool

1000hrs UK EU EuroZone CPI (est 0.43%mom / 1.21%yoy vs previous 1.0% / 1.3%)

1300hrs UK EU ECB President Mario Draghi speaks in Frankfurt

1330hrs UK US Atlanta Fed President Raphael Bostic speaks in Augusta, Gerogia

1330hrs UK EU The ECB’s Benoit Coeure speaks in Frankfurt

1330hrs UK US Housing Starts (est 1310K / -0.62%mom vs previous 1319K / 1.9%)

1415hrs UK US Industrial Production (est 0.58% vs previous 0.5%)

1415hrs UK US Capacity Utilisation (est 78.38% vs previous 78.0%)

1530hrs UK EU The ECB’s Praet speaks in Frankfurt

1530hrs UK US DOE Crude Oil Inventories (est -1348K vs previous -2197K)

1530hrs UK US DOE Gasoline Inventories (est -1373K vs previous -2174K)

1700hrs UK CH Swiss National Bank’s Jordan speaks in Zurich

1715hrs UK CA Bank of Canada’s Lawrence Schembri speaks in Ottawa

2230hrs UK US St Louis Fed President James Bullard holds a press briefing in St Louis

Earnings releases from US include Macys, Take Two Software, and Cisco

In the UK, HSBC, Intertek and Tesco all prepare to go ex div tomorrow whilst Burberry release earnings this morning

The Day So Far….

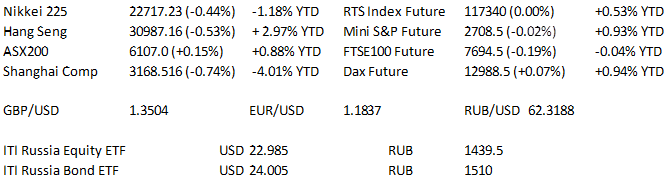

STOCKS: A surge in US Government bond yields to their highest level in almost 7 years sent Wall Street stocks sliding yesterday after strong Retail Sales numbers stoked inflation fears and added to worries over looming trade talks between the USA and China. All the major benchmarks closed lower – the Nasdaq100 losing 75.837 points to 6888.536, the Dow dropped 193 points to close 24706.41, and the S&P500 lost 18.68 points to end the day at 2711.45. This ended a four day winning streak for the S&P500, and 8 days of winners for the Dow. The yield on 10-year US T Notes jumped to their highest level since July 2011, suggesting an uptick in inflation and sending the $ index to its highest close so far this year, raising expectations of further interest rate hikes from the Federal Reserve.

Asian stocks have continued to weaken following yesterday`s losses, despite recovering off their lows. The Hang Seng has dropped 0.3% due to broad-based weakness, with energy underperforming and consumer staples representing the only positive subsector. The Shanghai Composite has also shed another 0.3%. A choppy session saw the Nikkei end the day just over 100 points lower but off the lows

Australia`s ASX has been the outperformer among the major indices, gaining slightly led by the energy sector. US equity trading up and down overnight, with both benchmarks currently unchanged

US TSYS: US T-Note futures have clawed back some losses during the Asia-Pacific session, consolidating following Tuesday's large selloff amid light news flow. The yield curve has also flattened slightly with the 2s/10s dropping back down to 48.7bps and the 5s/30s edging down to 27.8bps. Eurodollar futures have remained flat following yesterday's drop 3 ticks to give a 8.8% probability that the Fed surprises with 3 more hikes this year. T-Notes last at 118-24, US Tsy ylds: 2Y 2.568%, 3Y 2.740%, 5Y 2.908%, 7Y 3.025%, 10Y 3.061%, 30Y 3.189%.

GOLD: Gold has recovered some losses overnight following the break lower yesterday, currently trading at 1,294 with the 200DMA turning from support to resistance at 1,307. The yellow metal is `catching down` to trend in US real interest rates that have been in play for some time and on this basis there is further weakness to come, particularly if the US yield curve begins to bear flatten. Uptrend support from the Dec 2016 low comes in at 1,284, a break of which would open up a potential significant move lower.

OIL: Oil fell yesterday weighed down by ample supplies despite ongoing output cuts by producer cartel OPEC and looming US sanctions against major crude supplier Iran. Watch out for the DOE numbers later today, Brent last traded 78.17 with WTI last at 71.01

FOREX: The dollar continues to trade in a very tight range following yesterday`s rally, with the EUR just about holding yesterday`s low of 1,1820 and the JPY trading in the middle of its 110.20-110.40 range.

- The AUD`s recovery off the lows has been slightly more pronounced with overnight early weakness recovering as 0.7447 held firm.

- US yields looks set to continue dominating FX movements as we head into European hours, with the ongoing trend of higher yields keeping the greenback on the front foot.

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk