Overnight Snapshot

The Day Ahead

0930hrs UK UK Construction PMI (est 50.79 vs 51.4)

1000hrs UK EU Eurozone Unemployment Rate (est 8.51% vs previous 8.6%)

1000hrs UK EU Eurozone Core CPI (est 1.12% vs previous 1.0%)

1200hrs UK US MBA Mortgage Applications (previous 4.8%)

1445hrs UK US St Louis Fed President James Bullard speaks in Little Rock, Arkansas

1445hrs UK US Markit Services PMI (est 54.15 vs previous 54.1)

1500hrs UK US ISM Non-Manufacturing Index (est 58.79 vs previous 59.5)

1500hrs UK US Factory Orders (est 1.62% vs previous -1.4%)

1500hrs UK US Durable Goods Orders (previous 3.1%)

1530hrs UK US DOE Crude Oil Inventories (est 1396.82K vs previous 1643K)

1530hrs UK US DOE Gasoline Inventories (est -1577.64K vs previous -3472K)

1600hrs UK US Cleveland Fed’s Loretta Mester speaks in Wilberforce, Ohio

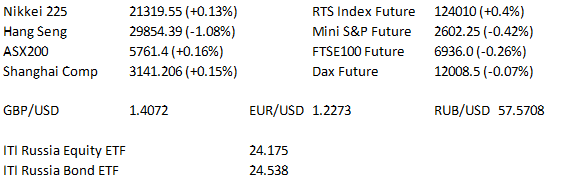

The Day So Far….

STOCKS: The there major US indices ended higher yesterday after a choppy session with investors looking ahead to earnings season. The S&P500 pushed back above the important 200 day moving average and Amazon shares bounced on bets that criticism from President Trump would not flow through to policy changes. After a volatile session, AMZN finished being the biggest boost for the tech heavy Nasdaq100, adding over 20 points to the gain of 67.99 as the index closed at 6458.831 The S&P500 traded above the 200day m.a. with a strong rally in the last hour to close +32.57 at 2614.45, whilst the Dow followed the same pattern to close 389.17 points to the good, and above the psychological 24,000 level at 24033.36

Asian stocks failed to capitalise on Wall St.'s Tuesday recovery, with the major indices trading lower as trade war worries dented sentiment across the region. Japanese investors however took heart from optimism on the global economy to rally in the afternoon session to close slightly up. Shares in mainland China seem to have shrugged off fears over a tariff war to trade positive all day, whilst Hong Kong shares suffer- US index futures edged lower as fears surrounding the scale of the trade wars ticked higher.

US TREASURY: US Tsys were weaker across the curve as volume picked up following the Easter weekend, and as equities recovered some of Monday's sharp sell-off.

- After hours Fed Gov. Brainard reiterated that in her view "gradual rate increases are appropriate", as she highlighted that US trade policy provides a 'material uncertainty' to economic outlook, while she is of the belief that it is quite likely that rates will rise above the predicted 'neutral' level in coming years owing to fiscal stimulus.

OIL: Crude futures moved lower overnight as WTI lost $0.25 to trade at $63.35, while Brent lost $0.25 to trade at $67.90. - The move lower came as dampened risk sentiment outweighed the reported surprise draw in headline crude stocks in

the latest API crude inventory estimate, with the reports pointing to a notable build in Cushing stocks as well as an increase in both distillate & gasoline stocks.

GOLD: Gold stuck to a sub $5 range in Asia, adding $2 to trade around $1,335 in spot dealing as Asian equities ticked lower.

FOREX: The USD moved lower overnight as the spectre of the US-China trade war lingered over markets. - AUD paid more attention to the stronger than exp. domestic retail sales data than to the soft Chinese Caixin Services PMI print.

AUDUSD breached 0.7700, before running into headwinds around the hourly resistance level at 0.7718. NZDUSD also managed to move higher, last at 0.7295, breaching the 55-DMA, with the next resistance level noted at the low from Mar

14 (0.7315). - CAD benefitted from the commodity currency strength consolidating below 1.2800, last at 1.2785, after a clean break of some key technical levels. Downside attention now falls on the 1% volatility band & Feb 22 high at

1.2756/58. - USDJPY moved away from the early Asia highs to print at 106.50, with talk of fund related bids in front of 106.40, with larger bids from Tokyo funds said to lie around 105.80. GBP & EUR also managed to lodge gains vs. USD in Asia trade.

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk