We think that sanctions against Russia will get tougher and there is at least 60% chance that they will include sanctions against OFZ on the primary market (unprecedent). Other sanctions’ provisions would have a neutral impact. The banking targets will be limited to non-systemic lenders such as Promsvyazbank. We think the immediate impact will be quite painful but in the medium term the market will partially restore and consolidate but would remain in the lower boundary range. Recovery is conditional on whether there will be further sanctions, as it was the case in 2014, or not. We estimate that the US sanctions will be announced before April and hence recommend to take hedging positions before that.

On February 13, U.S. Senators introduced bipartisan legislation, the Defending American Security from Kremlin Aggression Act (DASKA), basically an updated version of a previous bill that failed to muster enough support. The first version of the bill provided for sanctions against Russia's sovereign debt and state banks. The key difference between the two is that the new revised legislation does not contain a list of banks that could be the target of new sanctions. This time the president will determine himself which banks to be sanctioned. The new legislation includes a requirement to submit reports on Russian and Ukraine-related issues to the U.S. administration. In particular, the senators want to know why the sanctions were not imposed as early as November 2018, when Russia refused to open up its scientific and security facilities to international inspections to assess whether it is producing chemical and biological weapons in violation of international law.

There are rules and procedures which guide how U.S. Congress converts ideas for legislation into laws. For the bill to become law, the proposal must be passed by committees, the Senate and the House of Representatives, and both houses must agree to identical versions of the bill. After passage by both houses, a bill is sent to the president for approval. The president may sign the bill and make it law. The President may also choose to veto the bill, returning it to Congress with his objections. In such a case, the bill only becomes law if each house of Congress votes to override the veto with a two-thirds majority. Currently, the congress is considering several bills providing for sanctions against Russia, which can both compete with DASKAA or merge with it.

The bill's most crushing provision is sanctions against OFZ on primary market. We believe the chances of U.S. sanctioning sovereign debt have increased to 60% from 40% at the end of 2018 when our preliminary view was published.

We have taken a close look at the legislation and assessed the implications for the Russian assets. We assume the U.S. will decide on Russia sanctions by late March. However, extension cannot be ruled out.

*Spread between UST 10yr and Russia 10yr sovereign Eurobond

** Spread between local OFZ yield curve over time

Source: ITI Capital, Bloomberg

The bill’s key provisions and our take

1. The new provisions target investors in Russian new sovereign debt with a maturity of more than 14 days.

Our take:

- From April to December 2018, OFZ bonds held by foreigners dropped by 8% (561 bln roubles/$8.5 bln), to 24.4% (8 trln roubles/$27 bln), the lowest since May 2016. Most of them (over 70%) have been at the long end of the curve for over five years now

- The sanctions against primary OFZ market are meant to limit residents’ participation at the long end of the curve, and therefore limit borrowings to finance federal budget. It seems that the measure will do little to harm Russia — the country is on track to earn over 2 trln roubles in budget revenue in 2019 from a VAT hike and O&G revenues which quenches the government’s needs for additional financing. For example in January, budget revenues climbed by 14% to 1.5 trln roubles thanks to 25% surge in non-oil and gas revenues. VAT revenues accounted for 68% of all non-oil and gas revenues in January after VAT rate increased from 18% to 20%

- Short term implications could be quite painful for Russian risk assets (equity, FX and fixed income), given that most of the USD/RUB FX-market players are non-residents, and many of them will want to close their positions by shedding their OFZ holdings. If this is the case, foreign OFZ-holdings will tumble to 19% indicating a 370 bln roubles outflow and the rouble’s weakening to >71 roubles per dollar. In the medium/long term, the news will have little impact

2. Sanctions with respect to financial institutions that support interference in democratic processes or elections.

- Our view is that major Russian banks were not involved in these violations any didn’t provide any financial support for interference. So far Bank Rossiya has been the only major Russian lender designated by OFAC. Following sanctions, the bank expanded into Crimea, while other players stayed away from the peninsula wary of possible restrictions

3. Sanctions with respect to support for the development of crude oil resources in Russia.

— The wording of the provision is too broad, it’s reasonable to wait for further details.

4. Sanctions with respect to transactions related to investments in Russian liquefied natural gas (LNG) export facilities located outside of Russia.

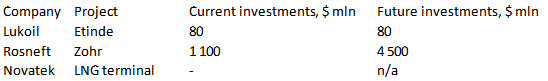

There are a very few LNG investment projects undertaken by Russian O&G outside Russia, we have analysed the most important ones.

Source: ITI Capital, Bloomberg

LNG-sanctions related to overseas facilities raise the following questions:

- Will the assets be blocked pursuant to OFAC’s 50 Percent Rule (if so, it is irrelevant for the ongoing projects)

- Will the sanctions be extended to gas field development projects that involves LNG capacity (not stand-alone LNG projects, but production + LNG)

- Will restrictions apply to other LNG-related projects: construction of transshipment facilities, trading, etc.

- Lukoil holds a 37,5% stake in the Etinde offshore block development project in the Gulf of Guinea off Cameroon. Partners in the field comprise New Age Offshore Petroleum SA and Bowleven. The operators received export authorization from the Cameroonian authorities. In the mid-2018, Bowleven and its partners suffered a disappointment on the IM-6 well drilling which did not make an additional commercial discovery (presence of hydrocarbons). The cost of the well is $156 mln, according to Lukoil assessment. With 50% of investments provided by Lukoil, the company’s loss from disposal may reach as much as $80 million. Results of the second well and the cost of drilling have not been disclosed so far

- According to Lukoil, the company's promising projects in the West Africa (Ghana, Cameroon) usually involve processing gas on LNG-facilities prior to selling it, but it is not yet clear who will build LNG production facilities and on what terms, since the deposits are subject to additional exploration and resource potential evaluation

- In 2017, Rosneft closed the deal to acquire a 30% stake in the concessions agreement for the development of Zohr field, the largest gas field in the Mediterranean Sea. The cost of the stake acquisition was $1.1 bln. The company’s investments in the project in 2018–2021 are estimated at $4.5 bln. The field started up in December 2017. By the end 2019, the gas output is estimated to reach the design capacity of 76 million cmd. Egypt is expected to once again return to being a net gas exporter in 2019, as the country’s have idle LNG-capacities and production exceeds domestic demand. As of today, it is unclear whether Rosneft will participate in the LNG-production in Egypt directly or as partner in Zohr project

- The Fluxys and Novatek joint venture Rostock LNG GmbH has signed a land lease agreement with the Port of Rostock with a view to building and operating a mid-scale liquefied natural gas (LNG) storage terminal with capacity of approximately 300 thousand tons per annum

- Gazprom’s subsidiary, Gazprom Marketing & Trading Singapore Pte Ltd (GM&TS), has signed an agreement according to which it will be a sole off-taker from the floating liquefied natural gas (FLNG) project, located off the coast of Kribi, Cameroon. Golar LNG project was launched in March 2018. GM&TS to purchase 1.2 million tons of LNG a year

5. Sanctions with respect to a person, including any financial institution, that knowingly engages in significant transactions with any person that supports or facilitates malicious cyber activities.

6. Sanctions with respect to political figures, oligarchs, and other persons that facilitate illicit and corrupt activities, directly or indirectly, on behalf of Vladimir Putin.

7. Sanctions with respect to senior officers of the Federal Security Service for detaining 24 Ukrainian naval personnel in Kerch Strait incident.

Scenario analysis (ITI Capital)

Neutral scenario (20%)

- The least likely scenario provides for limitation of aid programmes, a ban on US banks making almost any loan or providing any credit to the Russian government (note that, Russia is a net-creditor of the U.S., given its U.S. treasuries holdings) and lowering the level of diplomatic representation. Trade limitations (except for food or other agricultural commodities or products) are as irrelevant to the markets as the mentioned restrictions

- The State Department has repeatedly stated that the U.S. Government should continue to provide «international assistance to Russia and the Russian people.» That is to say, many groups of products will not be added to the U.S. Commerce Department Entity List that imposes a license requirement for the export of products to Russia

Baseline scenario (60%)

- The chances of U.S. imposing tougher sanctions stand at 60%. The key provision targets non-residents trade on the OFZ primary market which could have a similar effect on the Russian assets as was the case with unprecedented SDN sanctions against Rusal in April 2018

- The immediate outcome would be negative and harmful for the markets — sovereign and quasi-sovereign bonds with long duration could shed few percentage points. Going forward, OFZs may recover partly and consolidate if the state banks are not hit by further sanctions. The sanctions would not limit primary OFZ market and current non-resident holdings will not be exposed to any limitations in trading on secondary market

- It is important to note that many state banks (such as VEB, Sberbank and Gazprombank) have been on the EU and US financial sanctions list since the second half of 2014. They are no allowed to attract new borrowing in foreign currency, through funding and placement of new debt

Worst-case scenario (20%)

- The chances of U.S. imposing tough sanctions stand at 20%

- Under the scenario, Russian state banks' US-dollar settlements, trade operations, including O&G export settlements are blocked (as it is now the case with Iran with the US trying to extend embargo on the export of Iranian oil and freeze all foreign currency settlements with international banks)

- Essentially, this means that the Russian banks will be cut off from international settlements system and will not be able to attract FX-funding

- The most pessimistic outlook with respect to the state banks such as VEB suggests assets freeze and a ban on US operations, or a ban on its entire operations and an SDN designation (as it was the case with Rusal). VEB's US dollar-denominated holding account for 32.3% of the banks' credit portfolio, or 580 bln roubles ($8.6 bln), according to the bank’s presentation

- The bank's portfolio is expected to add 100 bln roubles of Rusal's debts (following the company's refusal to borrow from Promsvyazbank). At the same time, the cumulative volume of VEB outstanding eurobonds held by foreigners, primarily by the US/European funds, exceeds $6 bln

.png)

.png)

.png)